Proctor and Gamble 2016 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Procter & Gamble Company 13

Morris Trust split-off transaction in which P&G shareholders

could elect to participate in an exchange offer to exchange their

P&G shares for Coty shares. The Company expects to

complete this transaction in October 2016. The results of the

Beauty Brands are now presented as discontinued operations

and, as such, are excluded from both continuing operations and

segment results for all periods presented. Additionally, the

Beauty Brands' balance sheet positions as of June 30, 2016 and

June 30, 2015 are presented as held for sale in the Consolidated

Balance Sheets.

During fiscal 2015, the Company completed the divestiture of

its Pet Care business. The gain on the transaction was not

material. The results of the Pet Care business are presented as

discontinued operations and, as such, are excluded from both

continuing operations and segment results for all periods

presented.

With these transactions and other recent minor brand

divestitures, the Company will have substantially completed

the strategic portfolio reshaping program.

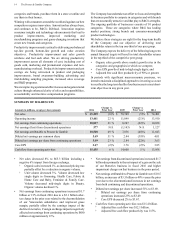

Beauty: We are a global market leader in the beauty category.

Most of the beauty markets in which we compete are highly

fragmented with a large number of global and local

competitors. We compete in skin and personal care and in hair

care. In skin and personal care, we offer a wide variety of

products, ranging from deodorants to personal cleansing to skin

care, such as our Olay brand, which is one of the top facial skin

care brands in the world with over 7% global market share. In

hair care, we compete in the retail channel. We are the global

market leader in the retail hair care market with over 20%

global market share primarily behind our Pantene and Head &

Shoulders brands.

Grooming: We compete in Shave Care and Appliances. In

Shave Care, we are the global market leader in the blades and

razors market. Our global blades and razors market share is

nearly 65%, primarily behind the Gillette franchise including

Fusion, Mach3, Prestobarba and Venus. Our appliances, such

as electric razors and epilators, are sold under the Braun brand

in a number of markets around the world where we compete

against both global and regional competitors. We hold over

20% of the male shavers market and nearly 45% of the female

epilators market.

Health Care: We compete in oral care and personal health

care. In oral care, there are several global competitors in the

market and we have the number two market share position with

nearly 20% global market share behind our Oral-B and Crest

brands. In personal health care, we are a top ten competitor in

a large, highly fragmented industry, primarily behind

respiratory treatments (Vicks brand), nonprescription

heartburn medications (Prilosec OTC brand) and digestive

wellness products (Metamucil, Pepto Bismol, and Align

brands). Nearly all of our sales outside the U.S. in personal

health care are generated through the PGT Healthcare

partnership with Teva Pharmaceuticals Ltd.

Fabric & Home Care: This segment is comprised of a variety

of fabric care products including laundry detergents, additives

and fabric enhancers; and home care products including

dishwashing liquids and detergents, surface cleaners and air

fresheners. In fabric care, we generally have the number one

or number two market share position in the markets in which

we compete and are the global market leader with nearly 30%

global market share, primarily behind our Tide, Ariel and

Downy brands. Our global home care market share is nearly

25% across the categories in which we compete.

Baby, Feminine & Family Care: In baby care, we compete

mainly in diapers, pants and baby wipes with nearly 30% global

market share. We are the number one or number two baby care

competitor in most of the key markets in which we compete,

primarily behind Pampers, the Company's largest brand, with

annual net sales of nearly $9 billion. We are the global market

leader in the feminine care category with over 25% global

market share, primarily behind Always. We also compete in

the adult incontinence category in certain markets, achieving

over 10% market share in the markets where we compete. Our

family care business is predominantly a North American

business comprised largely of the Bounty paper towel and

Charmin toilet paper brands. U.S. market shares are over 40%

for Bounty and over 25% for Charmin.

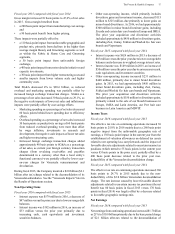

Selling and Market Operations

Our SMOs are responsible for developing and executing go-

to-market plans at the local level. The SMOs include dedicated

retail customer, trade channel and country-specific teams. Our

SMOs are organized under six regions comprised of North

America, Europe, Latin America, Asia Pacific, Greater China

and India, Middle East and Africa (IMEA). Throughout the

MD&A, we reference business results in developed markets,

which are comprised of North America, Western Europe and

Japan, and developing markets which are all other markets not

included in developed.

Global Business Services

GBS provides technology, processes and standard data tools

to enable the GBUs and the SMOs to better understand the

business and better serve consumers and customers. The GBS

organization is responsible for providing world-class solutions

at a low cost and with minimal capital investment.

Corporate Functions

CF provides company-level strategy and portfolio analysis,

corporate accounting, treasury, tax, external relations,

governance, human resources and legal, as well as other

centralized functional support.

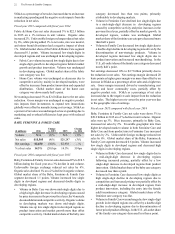

STRATEGIC FOCUS

P&G aspires to serve the world’s consumers better than our

best competitors in every category and in every country in

which we compete, and, as a result, deliver total shareholder

return in the top one-third of our peer group. Delivering and

sustaining leadership levels of shareholder value creation

requires balanced top-line growth, bottom-line growth and

strong cash generation.

Our strategic choices are focused on winning with consumers.

The consumers who purchase and use our products are at the

center of everything we do. We increase the number of users

- and the usage - of our brands when we win at the zero, first

and second moments of truth: when consumers research our