Proctor and Gamble 2016 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

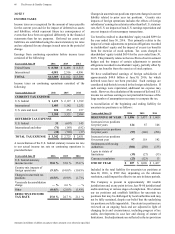

The Procter & Gamble Company 37

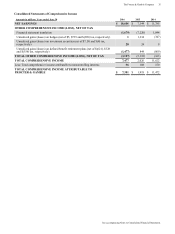

See accompanying Notes to Consolidated Financial Statements.

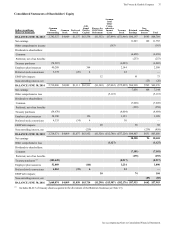

Consolidated Statements of Shareholders' Equity

Dollars in millions;

Shares in thousands

Common

Shares

Outstanding

Common

Stock

Preferred

Stock

Add-

itional

Paid-In

Capital

Reserve for

ESOP Debt

Retirement

Accumu-

lated

Other

Comp-

rehensive

Income/

(Loss)

Treasury

Stock

Retained

Earnings

Non-

controlling

Interest Total

BALANCE JUNE 30, 2013 2,742,327 $4,009 $1,137 $63,538 ($1,352) ($7,499) ($71,966) $80,197 $645 $68,709

Net earnings 11,643 142 11,785

Other comprehensive income (163) (163)

Dividends to shareholders:

Common (6,658) (6,658)

Preferred, net of tax benefits (253) (253)

Treasury purchases (74,987) (6,005) (6,005)

Employee plan issuances 40,288 364 2,144 2,508

Preferred stock conversions 3,178 (26) 4 22 —

ESOP debt impacts 12 61 73

Noncontrolling interest, net 5 (25) (20)

BALANCE JUNE 30, 2014 2,710,806 $4,009 $1,111 $63,911 ($1,340) ($7,662) ($75,805) $84,990 $762 $69,976

Net earnings 7,036 108 7,144

Other comprehensive loss (5,118) (5,118)

Dividends to shareholders:

Common (7,028) (7,028)

Preferred, net of tax benefits (259) (259)

Treasury purchases (54,670) (4,604) (4,604)

Employee plan issuances 54,100 156 3,153 3,309

Preferred stock conversions 4,335 (34) 4 30 —

ESOP debt impacts 20 68 88

Noncontrolling interest, net (219) (239) (458)

BALANCE JUNE 30, 2015 2,714,571 $4,009 $1,077 $63,852 ($1,320) ($12,780) ($77,226) $84,807 $631 $63,050

Net earnings 10,508 96 10,604

Other comprehensive loss (3,127) (3,127)

Dividends to shareholders:

Common (7,181) (7,181)

Preferred, net of tax benefits (255) (255)

Treasury purchases

(1)

(103,449) (8,217) (8,217)

Employee plan issuances 52,089 (144) 3,234 3,090

Preferred stock conversions 4,863 (39) 6 33 —

ESOP debt impacts 30 74 104

Noncontrolling interest, net (85) (85)

BALANCE JUNE 30, 2016 2,668,074 $4,009 $1,038 $63,714 ($1,290) ($15,907) ($82,176) $87,953 $642 $57,983

(1)

Includes $4,213 of treasury shares acquired in the divestiture of the Batteries business (see Note 13).