Pottery Barn 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

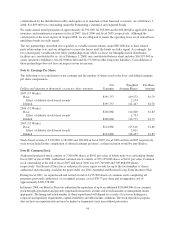

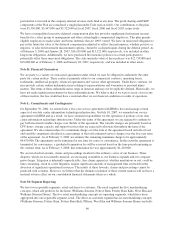

Quarterly Financial Information

(Unaudited)

Dollars in thousands, except per share amounts

Fiscal 2007 (53 Weeks)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Full

Year

Net revenues $816,051 $859,396 $895,132 $1,374,355 $3,944,934

Gross margin 301,970 320,095 342,081 571,825 1,535,971

Earnings before income taxes 30,381 43,394 44,679 197,886 316,340

Net earnings 18,150 25,966 27,077 124,564 195,757

Basic earnings per share1$ 0.16 $ 0.24 $ 0.25 $ 1.17 $ 1.79

Diluted earnings per share1$ 0.16 $ 0.23 $ 0.25 $ 1.15 $ 1.76

Stock price (as of quarter-end)2$ 35.67 $ 30.73 $ 30.61 $ 27.52 $ 27.52

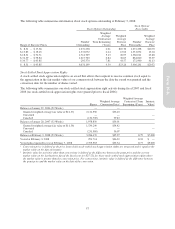

Fiscal 2006 (52 Weeks)

First

Quarter

Second

Quarter3

Third

Quarter

Fourth

Quarter

Full

Year

Net revenues $794,286 $825,536 $852,758 $1,254,933 $3,727,513

Gross margin 305,421 314,560 325,738 541,568 1,487,287

Earnings before income taxes 37,485 57,762 44,644 197,295 337,186

Net earnings 23,099 35,563 29,142 121,064 208,868

Basic earnings per share1$ 0.20 $ 0.31 $ 0.26 $ 1.08 $ 1.83

Diluted earnings per share1$ 0.20 $ 0.30 $ 0.25 $ 1.06 $ 1.79

Stock price (as of quarter-end)2$ 41.87 $ 32.23 $ 34.26 $ 34.24 $ 34.24

1The sum of the quarterly net earnings per share amounts will not necessarily equal the annual net earnings per share as

each quarter is calculated independently.

2Stock price represents our common stock price at the close of business on the Friday before our fiscal quarter-end.

3Includes a net pre-tax benefit of $10,200,000 in selling, general and administrative expenses related to unredeemed gift

certificate income due to a change in estimate and the Visa/MasterCard litigation settlement income, partially offset by the

expense associated with the departure of our former Chief Executive Officer.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

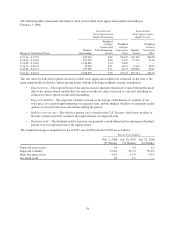

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

As of February 3, 2008, an evaluation was performed by management, with the participation of our Chief

Executive Officer (“CEO”) and our Executive Vice President, Chief Operating and Chief Financial Officer

(“CFO”), of the effectiveness of our disclosure controls and procedures. Based on that evaluation, our

management, including our CEO and CFO, concluded that our disclosure controls and procedures are effective to

ensure that information we are required to disclose in reports that we file or submit under the Securities

Exchange Act of 1934 is accumulated and communicated to our management, including our CEO and CFO, as

appropriate, to allow timely discussions regarding required disclosures, and that such information is recorded,

processed, summarized and reported within the time periods specified in the rules and forms of the SEC.

Changes in Internal Control Over Financial Reporting

There was no change in our internal control over financial reporting that occurred during our most recent fiscal

quarter that has materially affected, or is reasonably likely to materially affect, our internal control over financial

reporting.

64