Pottery Barn 2007 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

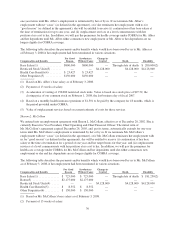

The Compensation Committee believes that each of these factors influences the type and number of shares

appropriate for each individual and that no one factor is determinative. The Compensation Committee granted

SSARs to four of the named executive officers in fiscal 2007 as shown in the “Grants of Plan-Based Awards”

table on page 25.

Mr. Miller received a grant of restricted stock units in fiscal 2005. The grant of restricted stock units was

designed to act as a long-term retention tool and was significantly larger than previous annual long-term

incentive awards. The grant contained a performance condition and a service condition. In November 2007, the

award was amended to remove the performance condition. The Board of Directors believed that removing the

performance condition and retaining the service condition would further enhance the retention value of the award

and was appropriate in light of current market conditions.

For future grants to the named executive officers, the Compensation Committee has decided to continue its use of

restricted stock units, as the Committee believes that awards with immediate value are powerful retention tools

and also result in less dilution to shareholders than awards such as stock options or SSARs. The Compensation

Committee intends to use restricted stock units in future long-term incentive grants to named executive officers,

but may decide to use other equity vehicles in the future as well.

In 2008, the Compensation Committee approved grants of restricted stock units to our fiscal 2008 named

executive officers in the following amounts (the number of restricted stock units granted is equal to the amounts

indicated below divided by the closing price of our common stock on the trading day prior to the grant date):

W. Howard Lester ......................................................... $945,000

Sharon L. McCollam ....................................................... $472,000

Laura J. Alber ............................................................. $472,000

Patrick J. Connolly ......................................................... $378,000

David M. DeMattei ........................................................ $472,000

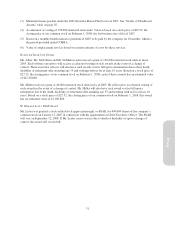

In determining the award amounts, the Compensation Committee took into account the Chief Executive Officer’s

recommendations. The Chief Executive Officer made grant recommendations based on his review of the

compensation levels of named executive officers in similar positions in our proxy peer group, at levels to ensure

that the long-term incentive amounts, when coupled with base salaries and target annual incentives, resulted in

total target direct compensation for each named executive officer between the 50th and 75th percentiles of our

proxy peer group. The Compensation Committee discussed the Chief Executive Officer’s recommendations and

approved the grants as recommended. The Compensation Committee determined the Chief Executive Officer’s

grant amount in an executive session following the meeting.

The Compensation Committee decided to designate a dollar amount for each grant (rather than designating a

number of restricted stock units to be granted) to ensure that the value of the compensation to be delivered was

not impacted by fluctuations in the company’s stock price prior to the grant date. The restricted stock units will

vest on the fourth anniversary following the effective date of grant, or May 2, 2012. The restricted stock units

also contain a one-year performance metric, based upon our profitability, designed to focus these named

executive officers on a shared business goal that guides our annual and long-term growth. This metric, because it

is based upon profitability, is deemed substantially uncertain of attainment for purposes of Internal Revenue

Code Section 162(m). When the goal was established, however, it was reasonably attainable based upon our

historic and expected levels of profitability. The Compensation Committee believes that these equity grants align

management’s interests with shareholder value creation and create a meaningful incentive for the named

executive officers to remain with the company for a significant period of time.

Prior to vesting, the named executive officers do not have the right to vote or receive dividends on these restricted

stock units. However, dividend equivalents on the shares underlying the grants will be accrued for the benefit of

each participant and paid upon the vesting date, if the underlying shares vest. The Compensation Committee

believes that dividend equivalents on the shares underlying the grants should be connected to the participant’s

39

Proxy