Pottery Barn 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

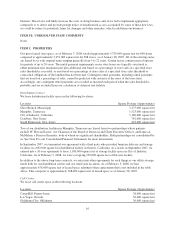

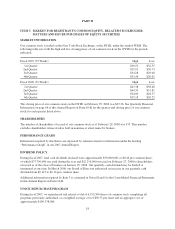

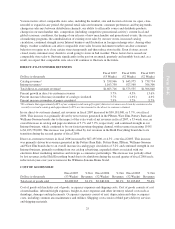

Fiscal 2007 Fiscal 2006 Fiscal 2005

Store

Count

Avg. LSF

Per Store

Store

Count

Avg. LSF

Per Store

Store

Count

Avg. LSF

Per Store

Williams-Sonoma 256 6,100 254 5,900 254 5,700

Pottery Barn 198 12,500 197 12,200 188 12,100

Pottery Barn Kids 94 7,900 92 7,900 89 7,800

West Elm 27 18,200 22 17,400 12 16,100

Williams-Sonoma Home 9 14,300 7 14,500 3 13,900

Outlets 16 20,500 16 20,200 16 20,200

Hold Everything1— — — — 8 7,600

Total 600 9,600 588 9,300 570 8,800

1During the first quarter of fiscal 2006, we closed our remaining eight Hold Everything stores.

Retail revenues in fiscal 2007 increased by $127,240,000, or 5.9%, over fiscal 2006. This increase was primarily

due to an increase in store leased square footage of 5.3% (including 23 new store openings and the remodeling or

expansion of an additional 26 stores), the impact of the extra week of net revenues in fiscal 2007, a 53-week year,

and comparable store sales growth of 0.3% in fiscal 2007. This increase was partially offset by the temporary

closure of 28 stores and the permanent closure of 9 stores during fiscal 2007. Net revenues generated in the West

Elm, Pottery Barn, Williams-Sonoma and Williams-Sonoma Home brands were the primary contributors to this

year-over-year revenue increase.

Retail revenues in fiscal 2006 increased by $121,071,000, or 6.0%, over fiscal 2005. This increase was primarily

due to an increase in store leased square footage of 8.3% (including 28 new store openings and the remodeling or

expansion of an additional 28 stores) and comparable store sales growth of 0.3% in fiscal 2006. This increase was

partially offset by the temporary closure of 24 stores and the permanent closure of 14 stores during fiscal 2006. Net

revenues generated in the West Elm, Williams-Sonoma, Pottery Barn Kids, Williams-Sonoma Home and Pottery

Barn brands were the primary contributors to the year-over-year revenue increase, partially offset by lost revenues

in the Hold Everything brand due to the closure of all its stores in late 2005 and the first quarter of fiscal 2006.

Comparable Store Sales

Comparable stores are defined as those stores in which gross square footage did not change by more than 20% in

the previous 12 months and which have been open for at least 12 consecutive months without closure for seven

or more consecutive days. By measuring the year-over-year sales of merchandise in the stores that have a history

of being open for a full comparable 12 months or more, we can better gauge how the core store base is

performing since it excludes new store openings, store remodelings, expansions and closings. Comparable stores

exclude new retail concepts until such time as we believe that comparable store results in those concepts are

meaningful to evaluating the performance of the retail strategy. For fiscal 2007 and fiscal 2006, our total

comparable store sales exclude the West Elm and Williams-Sonoma Home concepts. For fiscal 2005, our total

comparable store sales exclude only the West Elm concept as there were no Williams-Sonoma Home stores open

for a full comparable 12 months or more.

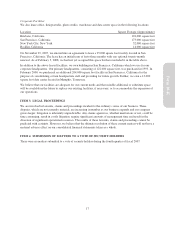

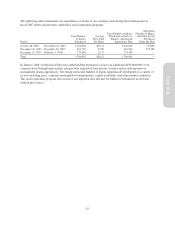

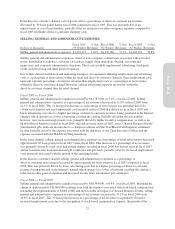

Percentages represent changes in comparable store sales versus the same period in the prior year.

Percent increase (decrease) in comparable store sales

Fiscal 2007

(53 Weeks)

Fiscal 2006

(52 Weeks)

Fiscal 2005

(52 Weeks)

Williams-Sonoma 0.7% 3.0% 2.8%

Pottery Barn (0.3%) (2.1%) 5.7%

Pottery Barn Kids (1.5%) 3.3% 5.2%

Outlets 5.8% (4.3%) 14.7%

Hold Everything1— — (10.7%)

Total 0.3% 0.3% 4.9%

1Hold Everything stores are excluded from the fiscal 2007 and fiscal 2006 comparable store sales calculation as this brand’s

remaining eight stores were closed in the first quarter of fiscal 2006.

24