Pottery Barn 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In December 2007, the FASB issued SFAS No. 141(Revised 2007), Business Combinations (“SFAS 141(R)”).

SFAS 141(R) will significantly change the accounting for business combinations. Under SFAS 141(R), an

acquiring entity will be required to recognize all the assets acquired and liabilities assumed in a transaction at the

acquisition date fair value with limited exceptions. SFAS 141(R) will change the accounting treatment for certain

specific acquisition-related items, including expensing acquisition-related costs as incurred, valuing non-

controlling interests (minority interests) at fair value at the acquisition date, and expensing restructuring costs

associated with an acquired business. SFAS 141(R) applies prospectively to business combinations for which the

acquisition date is on or after the first fiscal period beginning on or after December 15, 2008, except for

adjustments to a previously acquired entity’s deferred tax assets and uncertain tax position balances occurring

outside the measurement period, which are recorded as a component of income tax expense in the period of

adjustment, rather than goodwill. Early adoption is not permitted. Generally, the effect of SFAS 141(R) will

depend on future acquisitions and, as such, we do not currently expect the adoption of this Statement to have a

material impact on our consolidated financial position, results of operations or cash flows.

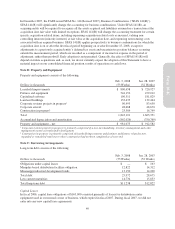

Note B: Property and Equipment

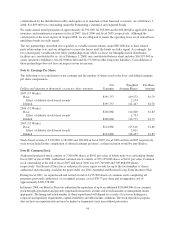

Property and equipment consists of the following:

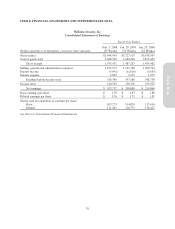

Dollars in thousands

Feb. 3, 2008

(53 Weeks)

Jan. 28, 2007

(52 Weeks)

Leasehold improvements $ 800,658 $ 720,927

Fixtures and equipment 544,152 479,012

Capitalized software 196,311 181,829

Land and buildings 133,435 132,464

Corporate systems projects in progress196,493 83,650

Corporate aircraft 48,668 48,670

Construction in progress223,384 16,799

Total 1,843,101 1,663,351

Accumulated depreciation and amortization (862,026) (750,769)

Property and equipment – net $ 981,075 $ 912,582

1Corporate systems projects in progress is primarily comprised of a new merchandising, inventory management and order

management system currently under development.

2Construction in progress is primarily comprised of leasehold improvements and furniture and fixtures related to new,

expanded or remodeled retail stores where construction had not been completed as of year-end.

Note C: Borrowing Arrangements

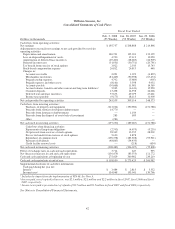

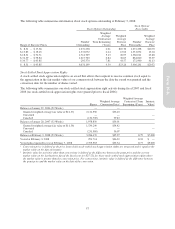

Long-term debt consists of the following:

Dollars in thousands

Feb. 3, 2008

(53 Weeks)

Jan. 28, 2007

(52 Weeks)

Obligations under capital leases $ — $ 163

Memphis-based distribution facilities obligation 12,822 14,312

Mississippi industrial development bonds 13,150 14,200

Total debt 25,972 28,675

Less current maturities 14,734 15,853

Total long-term debt $11,238 $12,822

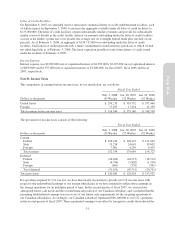

Capital Leases

In fiscal 2006, capital lease obligations of $163,000 consisted primarily of leases for distribution center

equipment used in our normal course of business, which expired in fiscal 2007. During fiscal 2007, we did not

enter into any new capital lease agreements.

49

Form 10-K