Pottery Barn 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

stock units granted in the exchange program under our 2001 Long-Term Incentive Plan will count as

1.9 shares for every one share granted under the award for purposes of calculating shares available for

future grant under the plan.

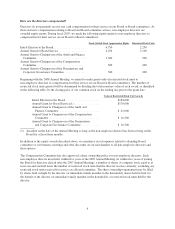

SUMMARY OF THE EXCHANGE PROGRAM

The following questions and answers provide a summary of the principal features of the proposed exchange program.

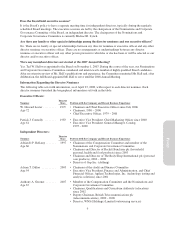

How will the exchange program work?

Our Board of Directors authorized the exchange program on April 23, 2008, upon the recommendation of the

Compensation Committee of our Board of Directors and subject to shareholder approval. The company has not

implemented the exchange program and will not do so unless our shareholders approve this proposal. If the

company receives shareholder approval of the proposal, it is anticipated that the exchange program would begin

within 12 months of the date shareholders approve the program at a time determined by the company.

Upon the start of the exchange program, employees holding eligible awards will receive a written offer that will

set forth the precise terms and timing of the exchange program. Eligible employees will be given at least 20

business days to elect to surrender their eligible awards in exchange for restricted stock units. Promptly following

the completion of the exchange offer, surrendered eligible awards will be canceled and the restricted stock units

will be granted in exchange.

At or before the start of the exchange program, we will file the offer to exchange with the SEC as part of a tender

offer statement on Schedule TO. Eligible employees, as well as shareholders and members of the public, will be

able to obtain the offer to exchange and other documents filed by us with the SEC free of charge from the SEC’s

website at www.sec.gov.

Why does the company want to implement an exchange program?

The company wants to implement an exchange program to restore the retention and incentive benefits of our

equity awards. The exchange program also will better align the value associated with the compensation expense

the company has booked and will continue to book in the future for these awards.

Our stock price, like that of many other companies in the retail and home-related industries, has declined

significantly in the past few years. We and other home goods retailers have been impacted by the downturn in the

housing market and declining consumer confidence, as well as other macro-economic factors. We believe the

decline in our stock price, and similar declines in the stock prices of our peer companies and in stock indices

such as the S&P Retail Index (RLX) and the PHLX Housing Sector Index (HGX), reflect investor concerns over

the housing crisis and a possible recession.

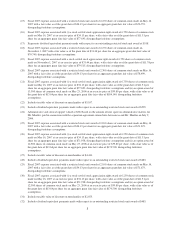

As a result of these factors, many of our employees hold options and/or SSARs with exercise prices significantly

higher than the current market price of our common stock. As of March 31, 2008, 100% of outstanding stock

options and SSARs granted after January 2004 that were held by our eligible employees were underwater. These

underwater awards may not be sufficiently effective to retain and motivate our employees to enhance long-term

shareholder value. We believe the exchange program would provide employees a meaningful incentive that is

directly aligned with the interest of our shareholders and would restore the lost retention value of the equity

compensation of such employees.

The exchange program also will have the added benefit of reducing the overhang represented by the outstanding

eligible awards. Further, the exchange program will help to remedy the fact that we are obligated to recognize

compensation expense for the underwater awards, even though they are not providing their intended incentive

and retention benefits, which we feel is not an efficient use of the company’s resources. Currently, the fair value

associated with outstanding underwater options and SSARs granted after January 2004 (other than those granted

to the members of our Board of Directors and our named executive officers) is approximately $65 million. Since

the exchange program is structured to replace underwater awards with restricted stock units of similar or lesser

value, the company will recognize no additional compensation expense. The only compensation expense we may

16