Pottery Barn 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.recognize taxable income upon settlement of the restricted stock units that is subject to income and employment

tax withholding. Except for the vesting schedule described above, all other terms and conditions of the restricted

stock units issued in the exchange program will be substantially the same as those that apply to restricted stock

units granted previously under the 2001 Long-Term Incentive Plan.

Will the terms of the exchange program be exactly as described in this proposal?

While the terms of the exchange program are expected to be materially similar to the terms described in this

proposal, we may find it necessary or appropriate to change the terms of the exchange program to take into

account our administrative needs, local law requirements, accounting rules, company policy decisions that make

it appropriate to change the exchange program and the like. For instance, although we will not in any

circumstances permit the members of our Board of Directors or our named executive officers to participate or

allow options priced below the applicable 52-week high or granted less than 20 months prior to the anticipated

end of the exchange program to participate, we may decide that it is appropriate to exclude additional executive

officers or exclude options granted below a higher price-point or that were granted as of an earlier date than

would otherwise be required by this proposal. As another example, we may alter the method of determining

exchange ratios if we decide that there is a more efficient and appropriate way to set the ratios while still

continuing to eliminate any incremental compensation expense to the fullest extent possible.

Additionally, we may decide not to implement the exchange program even if shareholder approval of the

exchange program is obtained or may amend or terminate the exchange program once it is in progress. The final

terms of the exchange program will be described in an offer to exchange that will be filed with the SEC.

Although we do not anticipate that the staff of the SEC will require us to materially modify the terms of the

exchange program, it is possible that we may need to alter the terms of the exchange program to comply with

comments from the staff.

What are the tax consequences to employees if they participate in the exchange program?

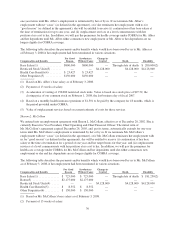

The following is a summary of the anticipated material U.S. federal income tax consequences of participating in

the exchange program. A more detailed summary of the applicable tax considerations to participants will be

provided in the exchange program documents. The law and regulations themselves are subject to change, and the

Internal Revenue Service is not precluded from adopting a contrary position. The exchange of eligible awards for

restricted stock units pursuant to the exchange program should be treated as a non-taxable exchange, and neither

we nor any of our employees should recognize any income for U.S. federal income tax purposes upon the

surrender of eligible awards and the grant of restricted stock units.

How will the restricted stock units be treated from an accounting perspective?

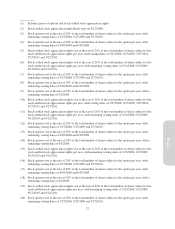

As of the beginning of our 2006 fiscal year, we have adopted the provisions of Financial Accounting Standards

Board Statement of Financial Accounting Standards No. 123 (Revised), or SFAS 123(R), on accounting for

share-based payments. Under SFAS 123(R), we will recognize incremental compensation expense, if any,

resulting from the restricted stock units granted in the exchange program. The incremental compensation cost

will be measured as the excess, if any, of the fair value of each award of restricted stock units granted to

employees in exchange for surrendered eligible awards, measured as of the date the restricted stock units are

granted, over the fair value of the eligible awards surrendered in exchange for the restricted stock units, measured

immediately prior to the exchange.

As noted above, the manner in which the exchange ratios for the exchange program will be set is intended to

result in the issuance of restricted stock units that have a fair value approximately equal to or less than the fair

value of the exchanged eligible awards they replace. As a result, this will eliminate any incremental

compensation cost that we must recognize for accounting purposes on the restricted stock units, other than

immaterial compensation expense that might result from fluctuations in our stock price after the exchange ratios

have been set (which will occur shortly before the exchange program begins) but before the exchange actually

20