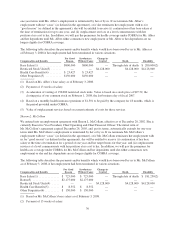

Pottery Barn 2007 Annual Report Download - page 124

Download and view the complete annual report

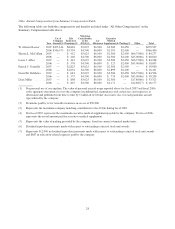

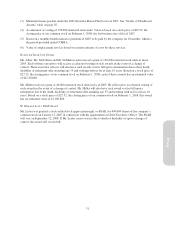

Please find page 124 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.report directly to the Compensation Committee. Frederic W. Cook & Co., Inc., or Frederic W. Cook, has been

engaged as an independent executive compensation consulting firm to assist the Compensation Committee in

discharging its responsibilities from time to time. During fiscal 2007, Frederic W. Cook provided the Compensation

Committee with proxy peer group and other publicly disclosed data related to named executive officers and director

compensation. Frederic W. Cook also provides certain services to management, primarily related to providing

market data and advice regarding general compensation trends in the retail industry and among similarly situated

companies. Frederic W. Cook did not provide any specific compensation recommendations regarding the data

provided to management or the Compensation Committee and did not attend any of the Compensation Committee

meetings in fiscal 2007. The Compensation Committee may request that Frederic W. Cook attend its meetings and

advise the Compensation Committee either in person or via telephone. Management currently relies on Frederic W.

Cook only for the provision of market data and does not now, or intend to in the future, solicit specific

compensation recommendations from Frederic W. Cook for our named executive officers.

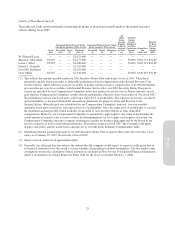

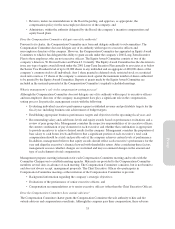

What is the Compensation Committee’s philosophy of executive compensation?

The Compensation Committee believes that the company’s executive compensation programs should support the

company’s objective of creating value for its shareholders. Accordingly, the Compensation Committee believes

that executive officers and other key employees should have a significant stake in the company’s stock

performance, and compensation programs should link executive compensation to shareholder value. For this

reason, the Compensation Committee strives to ensure that the company’s executive officer compensation

programs are designed to enable the company to attract, retain, motivate and reward highly qualified executive

officers while maintaining strong and direct links among executive pay, individual performance, the company’s

financial performance and shareholder returns.

One of the ways the Compensation Committee has sought to accomplish these goals is by making a significant

portion of individual compensation directly dependent on the company’s achievement of financial goals, and by

providing significant rewards for exceeding those goals. The Compensation Committee believes that strong

financial performance, on a sustained basis, is an effective means of enhancing long-term shareholder return.

There is no pre-established policy or target for the allocation between cash and non-cash compensation or short-

term and long-term compensation. Rather, the appropriate level and mix of compensation is reviewed and

determined on an ongoing basis, and at least annually.

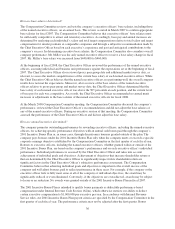

Historically, the Compensation Committee has awarded named executive officers equity in the form of stock

options and SSARs on an annual basis. Commencing in 2006, the Compensation Committee has also awarded

restricted stock units to named executive officers. In light of the changes in the macro-economic environment

and the effects of such changes on the company’s stock price, the majority of our outstanding stock option and

SSAR awards were granted at exercise prices that are higher than the company’s current stock price. Because of

this, in 2008, the Compensation Committee analyzed the appropriateness of continuing to grant stock options and

SSARs. Following this analysis, the Compensation Committee changed its approach with respect to executive

equity compensation in 2008. Specifically, no stock options or SSARs have been, or are anticipated to be,

granted to named executive officers in 2008. Instead, our named executive officers were granted restricted stock

units that vest 100% at the end of four years, subject to the company achieving a profitability metric in fiscal

2008. The profitability metric is considered substantially uncertain of attainment for Internal Revenue Code

Section 162(m) purposes, but is otherwise reasonably attainable. The Compensation Committee will continue to

evaluate the appropriate level and mix of equity compensation on an ongoing basis.

What are the components of executive compensation?

The Compensation Committee considers three major elements in the executive compensation program:

• Base salary;

• Annual incentive opportunities; and

• Long-term incentives.

34