Pottery Barn 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

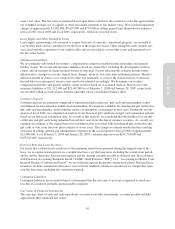

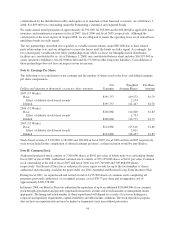

The following table summarizes the activity related to our gross unrecognized tax benefits:

Dollars in thousands, except per share amounts Total

Balance at January 29, 2007 $30,981

Increases related to current year tax positions 7,076

Increases for tax positions for prior years 712

Decreases for tax positions for prior years (1,010)

Settlements (1,979)

Lapse in statute of limitations (569)

Balance at February 3, 2008 $35,211

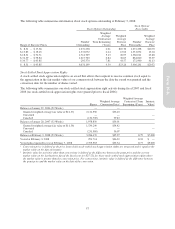

We accrue interest and penalties related to unrecognized tax benefits in the provision for income taxes. Upon the

implementation of FIN 48 (adopted on January 29, 2007) and as of February 3, 2008, our accruals for the

payment of interest and penalties totaled $5,983,000 and $9,006,000, respectively, all of which related to interest.

Due to the potential resolution of state issues, it is reasonably possible that the balance of our gross unrecognized

tax benefits could decrease within the next twelve months by a range of $3,000,000 to $16,000,000.

We file income tax returns in the U.S. federal jurisdiction, and various states and foreign jurisdictions. The

Internal Revenue Service (IRS) has concluded its examination of our U.S. federal income tax returns for years

prior to 2004 without any significant adjustments. Substantially all material state, local and foreign income tax

examinations have been concluded for years through 1999.

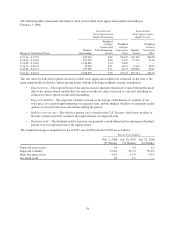

New Accounting Pronouncements

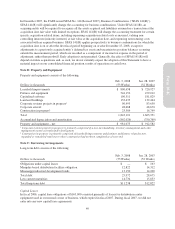

As of January 29, 2007, we adopted Emerging Issues Task Force (“EITF”) 06-3, “How Taxes Collected from

Customers and Remitted to Governmental Authorities Should Be Presented in the Income Statement (That Is, Gross

versus Net Presentation).” The scope of EITF 06-3 includes sales, use, value added and some excise taxes that are

assessed by a governmental authority on specific revenue-producing transactions between a seller and customer.

EITF 06-3 requires disclosure of the method of accounting for the applicable assessed taxes and the amount of

assessed taxes that are included in revenues if they are accounted for under the gross method. We present revenues

net of any taxes collected from customers and remitted to governmental authorities. The adoption of EITF 06-3 did

not have an impact on our consolidated financial position, results of operations or cash flows.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measures,” which establishes a single

authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional

disclosures about fair value measurements. SFAS No. 157 only applies to fair value measurements that are already

required or permitted by other accounting standards, except for measurements of share-based payments, and

measurements that are similar to, but not intended to be, fair value. This Statement is effective for fiscal years

beginning after November 15, 2007 for financial assets and liabilities. In November 2007, the FASB provided a one

year deferral for the implementation of SFAS No. 157 for nonfinancial assets and liabilities reported or disclosed at

fair value in the financial statements on a nonrecurring basis. This Statement will require additional disclosures in

our financial statements. We do not expect the adoption of SFAS No. 157 for financial assets and liabilities to have

a material impact on our consolidated financial position, results of operations or cash flows.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities – including an amendment of FASB Statement No. 115.” SFAS No. 159 will permit entities to choose

to measure eligible items at fair value at specified election dates and report unrealized gains and losses on items

for which the fair value option has been elected in earnings at each subsequent reporting date. This Statement is

effective for fiscal years beginning after November 15, 2007. We do not expect the adoption of SFAS 159 to

have a material impact on our consolidated financial position, results of operations or cash flows.

48