Pottery Barn 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

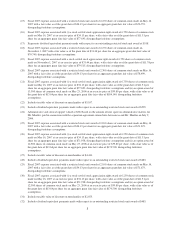

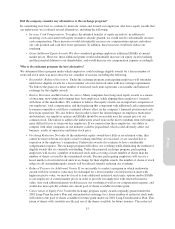

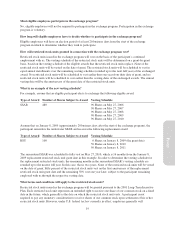

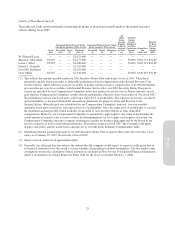

Although the exchange ratios cannot be determined now, we can provide an example if we make certain

assumptions regarding the start date of the offer, the fair value of the eligible awards, and the fair market value of

our common stock. For example, if we began the exchange program on December 10, 2008, which would allow

us to include in the exchange program a substantial percentage of our outstanding underwater awards, our then-

applicable 52-week high would be $30.51 (assuming our stock price does not rise above that price between now

and December 10, 2008). As a result, only options and SSARs with an exercise price above $30.51 per share and

that were granted at least 20 months prior to the anticipated end of the exchange program would be eligible for

the exchange program. If, at the time we set the exchange ratios, the fair market value of our common stock was

$26.50 per share, then based on the above method of determining the exchange ratio, the following exchange

ratios would apply:

If the Exercise Price of an Eligible Award is:

The Exchange Ratio Would Be

(Eligible Awards to Restricted Stock Units):

$30.52 - $33.06 5.1-to-1

$33.07 - $34.88 5.3-to-1

$34.89 - $35.58 4.3-to-1

$35.59 - $38.83 4.8-to-1

$38.84 - $39.76 4.1-to-1

$39.77 - $41.07 4.3-to-1

Above $41.07 4.6-to-1

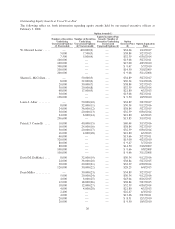

The total number of restricted stock units a participating employee will receive with respect to a surrendered

eligible award will be determined by converting the number of shares underlying the surrendered award

according to the applicable exchange ratio and rounding down to the nearest whole share. The exchange ratios

will be applied on a grant-by-grant basis.

For purposes of example only, if a participant exchanged an eligible award of 480 shares subject to an option

with an exercise price of $35.69 per share and the exchange ratio was 1 restricted stock unit for every 4.8 shares,

he or she would receive 100 restricted stock units in exchange for the surrendered eligible award (480 divided by

4.8). If the participant also exchanged another eligible award of 820 shares subject to an option with an exercise

price of $39.05 per share and the exchange ratio was 1 restricted stock unit for every 4.1 shares, he or she would

receive 200 restricted stock units in exchange for the surrendered eligible award (820 divided by 4.1).

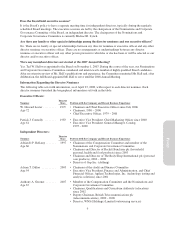

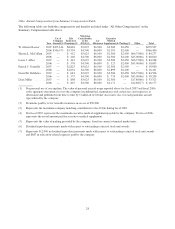

Continuing this example, if we assume that all currently eligible options and SSARs remain outstanding and the

award holders remain eligible to participate, the following table summarizes information regarding the eligible

awards and the restricted stock units that would be granted in the exchange:

Exercise Prices of Eligible Awards

Number of

Shares

Underlying

Eligible Awards

Weighted

Average

Exercise Price

of Eligible

Awards

Weighted Average

Remaining Life of

Eligible Awards

(Years) Exchange Ratio

Maximum

Number of New

Restricted

Stock Units

That May Be

Granted

$30.52 - $33.06 ............. 532,085 $32.18 5.35 5.1-to-1 104,330

$33.07 - $34.88 ............. 142,350 $33.65 7.51 5.3-to-1 26,858

$34.89 - $35.58 ............. 1,110,050 $34.89 8.27 4.3-to-1 258,151

$35.59 - $38.83 ............. 121,100 $36.36 6.02 4.8-to-1 25,229

$38.84 - $39.76 ............. 709,400 $38.85 6.49 4.1-to-1 173,024

$39.77 - $41.07 ............. 736,670 $40.41 7.25 4.3-to-1 171,318

Above $41.07 ............. 174,350 $42.72 6.82 4.6-to-1 37,902

Total ................. 3,526,005 796,812

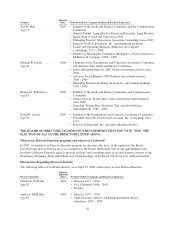

After the exchange as presented in this example (assuming all eligible awards are tendered and without including

any grants after March 31, 2008), there will be 7,790,449 shares available for grant, 6,056,639 options and

SSARs outstanding and 1,668,612 full value awards outstanding. These outstanding options and SSARs would

have a weighted average exercise price of $22.47 and a weighted average remaining term of 5.07.

18