Pottery Barn 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

OVERVIEW

Fiscal 2007 Financial Results

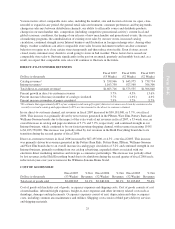

Including the impact from the additional week of net revenues in fiscal 2007, a 53-week year, our net revenues

increased 5.8% to $3,944,934,000 from $3,727,513,000 in fiscal 2006, a 52-week year, with positive growth in

all brands. Taking into account the generally bleak retail environment in the first half of the year, and the

recessionary warnings that followed in the back half of the year, we are pleased with these results, especially

when compared to the lower growth rates of the home furnishings industry overall in fiscal 2007. We believe the

strength of our brands and our multi-channel business model drove this increase.

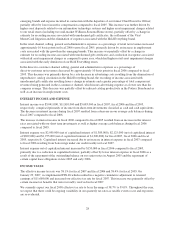

Including a net $0.013 per diluted share negative impact from the application of FIN 48, partially offset by an

estimated $0.05 per diluted share net benefit from the additional week in fiscal 2007, diluted earnings per share

decreased by 1.7% to $1.76 in fiscal 2007 from $1.79 in fiscal 2006.

From a cash flow perspective, fiscal 2007 was another strong year, generating $245,539,000 in net cash from operating

activities despite higher inventories and lower growth rates. In fiscal 2007, we returned $239,241,000 to our shareholders

through a combination of share repurchases and dividends, and ended the year with a cash balance of $118,950,000 after

internally funding all growth and infrastructure initiatives including $212,024,000 in capital expenditures.

In our retail channel, net revenues in fiscal 2007 increased by $127,240,000, or 5.9%, over fiscal 2006. This

increase was primarily due to an increase in store leased square footage of 5.3% (including 12 net new stores),

the impact of the extra week of net revenues in fiscal 2007, a 53-week year, and comparable store sales growth of

0.3%. Net revenues generated in the West Elm, Pottery Barn, Williams-Sonoma and Williams-Sonoma Home

brands were the primary contributors to this year-over-year revenue increase.

In our direct-to-customer channel, net revenues in fiscal 2007 increased by $90,181,000, or 5.7%, over fiscal

2006. This increase was driven by net revenues generated in the PBteen, West Elm, Pottery Barn and Williams-

Sonoma brands primarily due to the impact of the extra week of net revenues in fiscal 2007, a 53-week year, an

overall increase in catalog and page circulation of 3.7% and 7.9%, respectively, and continued strength in our

Internet business, which continued to be our fastest growing shopping channel, with revenues increasing 19.0%

to $1,103,750,000. This increase was partially offset by lost revenues in the Hold Everything brand due to its

transition during the second quarter of fiscal 2006.

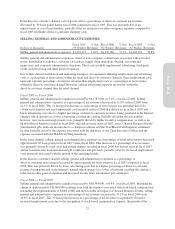

In our core brands, net revenues increased 3.4% over fiscal 2006 driven by net revenues generated in the Pottery

Barn, Williams-Sonoma and Pottery Barn Kids brands, primarily due to the benefit of the extra week of net

revenues in fiscal 2007, however, we were negatively impacted throughout the year by the general macro-

economic environment and its impact on the retail industry. In the Pottery Barn brand, we had continued growth

in e-commerce and saw benefits from the Pottery Barn brand revitalization strategies. We did, however, have a

comparable store sales decrease of 0.3%, primarily resulting from the significant weakness in the home

furnishings sector and an overall weakened macro-environment. In the Williams-Sonoma brand, we delivered

one of the best operating margins in our history due to the on-going success of our new merchandising, catalog

versioning and e-commerce strategies. In the Pottery Barn Kids brand, though net revenues increased overall, we

did see a comparable store sales decrease of 1.5% driven by on-going weakness in textiles and the overall effect

of the weakening macro-environment, which appears to be impacting Pottery Barn Kids more than our other

brands due to the brand’s significant dependence on broader discretionary categories such as core textiles.

In our emerging brands, including West Elm, PBteen and Williams-Sonoma Home, net revenues increased

36.0% over fiscal 2006, with positive growth in all brands. In West Elm, we expanded the reach of the brand and

drove incremental sales from our new and existing stores (with a total of 27 stores at the end of fiscal 2007), as

well as strong growth in e-commerce. In PBteen, we continued to see positive growth in all key merchandising

categories with new product innovation and superior execution driving this year-over-year revenue growth. In

Williams-Sonoma Home, we made significant progress on our key initiatives of building brand awareness,

21

Form 10-K