Pottery Barn 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

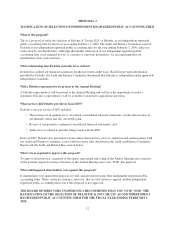

Did the company consider any alternatives to the exchange program?

In considering how best to continue to motivate, retain and reward our employees who have equity awards that

are underwater, we evaluated several alternatives, including the following:

•Increase Cash Compensation. To replace the intended benefits of equity incentives, in addition to

incurring costs associated with equity incentives already granted, we would need to substantially increase

cash compensation. These increases would substantially increase our compensation expense and reduce

our cash position and cash flow from operations. In addition, these increases would not reduce our

overhang.

•Grant Additional Equity Awards. We also considered granting employees additional SSARs at current

market prices. However, these additional grants would substantially increase our equity award overhang

and the potential dilution to our shareholders, and would increase our compensation expense accordingly.

Why is the exchange program the best alternative?

We determined that a program under which employees could exchange eligible awards for a lesser number of

restricted stock units was most attractive for a number of reasons, including the following:

•Reasonable, Balanced Incentives. Under the exchange program, participating employees will surrender

underwater eligible awards for a lesser number of restricted stock units with new vesting requirements.

We believe the grant of a lesser number of restricted stock units represents a reasonable and balanced

exchange for the eligible awards.

•Restore Retention and Motivation Incentives. Many companies have long used equity awards as a means

of attracting, motivating and retaining their best employees, while aligning those employees’ interests

with those of the shareholders. We continue to believe that equity awards are an important component of

our employees’ total compensation, and that replacing this component with additional cash compensation

to remain competitive could have a material adverse effect on the company’s financial position and cash

flow from operations. We also believe that in order to have the desired impact on employee motivation

and retention, our employee options and SSARs should be exercisable near the current price of our

common stock. The failure to address the underwater award issue in the near to medium term will make it

more difficult for us to retain our key employees. If we cannot retain these employees, our ability to

compete with other companies in our industry could be jeopardized, which could adversely affect our

business, results of operations and future stock price.

•Overhang Reduction. Not only do the underwater equity awards have little or no retention value, they

cannot be removed from our equity award overhang until they are exercised, or are canceled due to

expiration or the employee’s termination. Underwater awards also continue to have considerable

compensation expense. The exchange program will reduce our overhang while eliminating the ineffective

eligible awards that are currently outstanding. Under the proposed exchange program, participating

employees will receive a number of restricted stock units covering a lesser number of shares than the

number of shares covered by the surrendered awards. Because participating employees will receive a

lesser number of restricted stock units in exchange for their eligible awards, the number of shares of stock

subject to all outstanding equity awards will be reduced, thereby reducing our overhang.

•Reduced Pressure for Additional Grants. If we are unable to conduct a program in which underwater

awards with low incentive value may be exchanged for a lesser number of restricted stock units with

higher incentive value, we may be forced to issue additional restricted stock units, options and/or SSARs

to our employees at current market prices in order to provide our employees with renewed incentive

value. Any such additional grants would increase our overhang as well as our compensation expense, and

would also more quickly exhaust our current pool of shares available for future grant.

•Conservation of Equity Pool. Under the exchange program, equity awards originally granted under the

2001 Long-Term Incentive Plan and surrendered in exchange for a lesser number of restricted stock units

will return to the pool of shares available for future grant under our 2001 Long-Term Incentive Plan. This

return of shares will constitute an efficient use of the shares available for future issuance. The restricted

15

Proxy