Pottery Barn 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Results of Operations

NET REVENUES

Net revenues consist of retail sales, direct-to-customer sales and shipping fees. Retail sales include sales of

merchandise to customers at our retail stores. Direct-to-customer sales include sales of merchandise to customers

through our catalogs and the Internet. Shipping fees consist of revenue received from customers for delivery of

merchandise. Revenues are presented net of sales returns and other discounts.

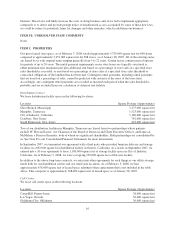

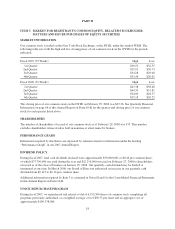

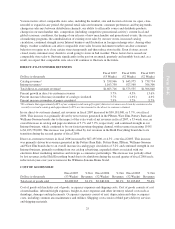

The following table summarizes our net revenues for the 53 weeks ended February 3, 2008 (“fiscal 2007”), the

52 weeks ended January 28, 2007 (“fiscal 2006”) and the 52 weeks ended January 29, 2006 (“fiscal 2005”):

Dollars in thousands

Fiscal 2007

(53 Weeks) % Total

Fiscal 2006

(52 Weeks) % Total

Fiscal 2005

(52 Weeks) % Total

Retail revenues $2,281,218 57.8% $2,153,978 57.8% $2,032,907 57.4%

Direct-to-customer revenues 1,663,716 42.2% 1,573,535 42.2% 1,506,040 42.6%

Net revenues $3,944,934 100.0% $3,727,513 100.0% $3,538,947 100.0%

Net revenues for fiscal 2007 increased by $217,421,000, or 5.8%, over fiscal 2006. This increase was primarily due

to an increase in store leased square footage of 5.3% (including 23 new store openings and the remodeling or

expansion of an additional 26 stores), the impact of the extra week of net revenues in fiscal 2007, a 53-week year,

and comparable store sales growth of 0.3% in fiscal 2007. This increase was further driven by an overall increase in

catalog and page circulation of 3.7% and 7.9%, respectively, and continued strength in our Internet business,

primarily resulting from our catalog advertising, expanded efforts associated with our electronic direct marketing

initiatives and strategic e-commerce partnerships. This increase was partially offset by lost revenues in the Hold

Everything brand, the temporary closure of 28 stores and the permanent closure of 9 stores in fiscal 2007.

Net revenues for fiscal 2006 increased by $188,566,000, or 5.3%, over fiscal 2005. This increase was primarily due

to an increase in store leased square footage of 8.3% (including 28 new store openings and the remodeling or

expansion of an additional 28 stores) and comparable stores sales growth of 0.3% in fiscal 2006. This increase was

further driven by an overall increase in catalog page circulation of 3.2% and continued strength in our Internet

business, primarily resulting from our catalog advertising, expanded efforts associated with our electronic direct

marketing initiatives and strategic e-commerce partnerships. This increase was partially offset by lost revenues in

the Hold Everything brand, the temporary closure of 24 stores and the permanent closure of 14 stores in fiscal 2006.

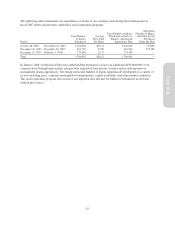

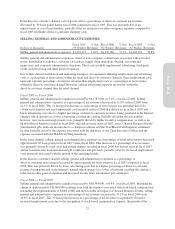

RETAIL REVENUES AND OTHER DATA

Dollars in thousands

Fiscal 2007

(53 Weeks)

Fiscal 2006

(52 Weeks)

Fiscal 2005

(52 Weeks)

Retail revenues $2,281,218 $2,153,978 $2,032,907

Percent growth in retail revenues 5.9% 6.0% 12.3%

Percent increase in comparable store sales 0.3% 0.3% 4.9%

Number of stores – beginning of year 588 570 552

Number of new stores 23 28 30

Number of new stores due to remodeling126 28 8

Number of closed stores due to remodeling1, 2 (28) (24) (12)

Number of permanently closed stores (9) (14) (8)

Number of stores – end of year 600 588 570

Store selling square footage at year-end 3,575,000 3,389,000 3,140,000

Store leased square footage (“LSF”) at year-end 5,739,000 5,451,000 5,035,000

1Remodeled stores are defined as those stores temporarily closed and subsequently reopened during the year due to square

footage expansion, store modification or relocation.

2Fiscal 2005 store closing numbers include two Williams-Sonoma, two Pottery Barn and one Pottery Barn Kids temporary

store closures in the New Orleans area due to Hurricane Katrina. One Williams-Sonoma store reopened before fiscal 2005

year-end. The remaining stores reopened in fiscal 2006.

23

Form 10-K