Pottery Barn 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PROPOSAL 3

APPROVAL OF EQUITY AWARD EXCHANGE PROGRAM

What is this proposal?

This is a proposal to approve the equity award exchange program. On April 23, 2008, our Board of Directors

authorized, subject to shareholder approval, an equity award exchange program (the “exchange program”) that

will permit our eligible employees to exchange certain outstanding stock options and/or stock-settled stock

appreciation rights (“SSARs”) (the options and/or SSARs eligible for the exchange program are referred to here

as “eligible awards”) with an exercise price above the per-share 52-week high of our common stock (measured as

of the start date of the exchange program) for a lesser number of restricted stock units to be granted under our

2001 Long-Term Incentive Plan. Our intent in using the 52-week high threshold of our common stock is to

ensure that only outstanding stock options and/or SSARs that are substantially “underwater” (meaning the

exercise prices of such awards are greater than our stock price) are eligible for the exchange program.

Why is the exchange program important?

For a number of reasons, we believe the exchange program is an important component in our strategy to align

employee and shareholder interests through our equity compensation practices. We believe that the exchange

program is important for the company because it will permit us to:

• provide renewed incentives for the employees who participate in the exchange program by issuing them

restricted stock units that will vest over a period of time following the exchange if they remain employed

with us. The restricted stock units will provide immediate intrinsic value to our employees and, at the

same time, the opportunity for even greater value if the stock price increases. Providing renewed

incentives to our employees is the primary purpose of the exchange program, and we believe the

exchange program will enable us to enhance long-term shareholder value by aligning the interests of our

employees more fully with the interests of our shareholders.

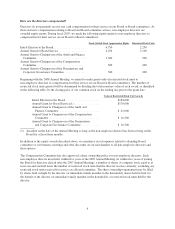

• meaningfully reduce our total number of outstanding equity awards, or “overhang,” represented by

outstanding awards that have high exercise prices and may no longer incentivize their holders to remain

as our employees. Keeping these awards outstanding does not serve the interests of our shareholders and

does not provide the benefits intended by our equity compensation program. By replacing the awards with

a lesser number of restricted stock units, our overhang is decreased. The overhang represented by the

restricted stock units issued pursuant to the exchange program will reflect an appropriate balance between

the company’s goals for its equity compensation program and our interest in minimizing our overhang

and the dilution of our shareholders’ interests.

• recapture value from compensation costs that we already are incurring with respect to outstanding equity

awards. These awards were granted at the then fair market value of our common stock. Under applicable

accounting rules, we will have to recognize approximately $97 million in compensation expense related

to these awards, $41 million of which has already been expensed as of February 3, 2008 and $56 million

of which we will continue to be obligated to expense, even if these awards are never exercised because

the majority remain underwater. We believe it is not an efficient use of the company’s resources to

recognize compensation expense on awards that do not provide value to our employees. By replacing

options and SSARs that have little or no retention or incentive value with restricted stock units that will

provide both retention and incentive value while not creating additional compensation expense (other than

immaterial expense that might result from fluctuations in our stock price after the exchange ratios have

been set but before the exchange actually occurs), the company will be making efficient use of its

resources.

The exchange program may take place if and only if the exchange program is approved by our shareholders.

If our shareholders do not approve the exchange program, eligible awards will remain outstanding and in

effect in accordance with their existing terms. We will continue to recognize compensation expense for these

eligible awards, even though the awards may have little or no retention or incentive value.

13

Proxy