Pottery Barn 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

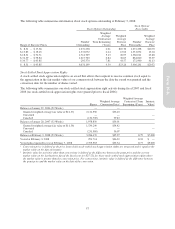

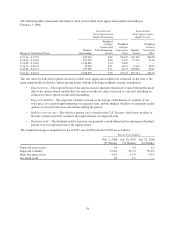

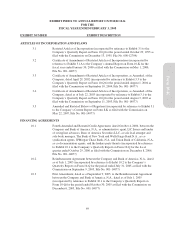

Restricted Stock Units

The following table summarizes our restricted stock unit activity during fiscal 2007, fiscal 2006 and fiscal 2005:

Weighted Average

Shares

Grant Date

Fair Value

Intrinsic

Value1

Balance at January 30, 2005 (52 Weeks) —

Granted 840,000 $42.18

Vested — — —

Canceled —

Balance at January 29, 2006 (52 Weeks) 840,000

Granted 70,000 $30.34

Vested — — —

Canceled (60,000)

Balance at January 28, 2007 (52 Weeks) 850,000

Granted 51,800 $32.71

Vested — — —

Canceled (70,000)

Balance at February 3, 2008 (53 Weeks) 831,800 $40.59 $22,891,000

Vested at February 3, 2008 — — —

Expected to Vest at February 3, 2008 762,153 $40.59 $20,974,000

1Intrinsic value for restricted stock units is defined as the market value on the last business day of the fiscal year (or $27.52).

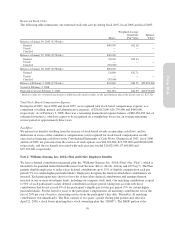

Total Stock-Based Compensation Expense

During fiscal 2007, fiscal 2006 and fiscal 2005, we recognized total stock-based compensation expense, as a

component of selling, general and administrative expenses, of $26,812,000, $26,759,000 and $440,000,

respectively. As of February 3, 2008, there was a remaining unamortized expense balance of $60,456,000 (net of

estimated forfeitures), which we expect to be recognized on a straight-line basis over an average remaining

service period of approximately three years.

Tax Effect

We present tax benefits resulting from the exercise of stock-based awards as operating cash flows, and tax

deductions in excess of the cumulative compensation cost recognized for stock-based compensation awards

exercised as financing cash flows in the Consolidated Statements of Cash Flows. During fiscal 2007, fiscal 2006

and fiscal 2005, net proceeds from the exercise of stock options was $28,362,000, $13,935,000 and $28,002,000,

respectively, and the tax benefit associated with such exercises totaled $10,821,000, $7,696,000 and

$15,743,000, respectively.

Note J: Williams-Sonoma, Inc. 401(k) Plan and Other Employee Benefits

We have a defined contribution retirement plan, the “Williams-Sonoma, Inc. 401(k) Plan” (the “Plan”), which is

intended to be qualified under Internal Revenue Code Sections 401(a), 401(k), 401(m) and 4975(e)(7). The Plan

permits eligible employees to make salary deferral contributions up to 15% of eligible compensation each pay

period (5% for certain higher paid individuals). Employees designate the funds in which their contributions are

invested. Each participant may choose to have his or her salary deferral contributions and earnings thereon

invested in one or more investment funds, including our company stock fund. Our matching contribution is equal

to 50% of each participant’s salary deferral contribution each pay period, taking into account only those

contributions that do not exceed 6% of the participant’s eligible pay for the pay period (5% for certain higher

paid individuals). For the first five years of the participant’s employment, all matching contributions vest at the

rate of 20% per year of service, measuring service from the participant’s hire date. Thereafter, all matching

contributions vest immediately. The Plan consists of two parts: a profit sharing plan portion and, effective

April 21, 2006, a stock bonus plan/employee stock ownership plan (the “ESOP”). The ESOP portion is the

59

Form 10-K