Pottery Barn 2007 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

amounts are not paid unless and until the Compensation Committee certifies that the performance objectives

have been achieved. The Compensation Committee considers the impact of deductibility on the net cost of

executive compensation and may determine under certain circumstances that it is appropriate to pay

compensation that does not meet the requirements of Section 162(m).

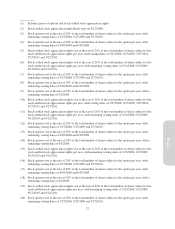

In March 2007, the Compensation Committee established a fiscal 2007 target annual incentive amount under the

2001 Incentive Bonus Plan (the “target bonus”) for all of the company’s named executive officers, including the

Chief Executive Officer. The target bonuses were set after a review of the respective responsibilities of the

named executive officers, the current combinations of pay elements for each named executive officer and

whether such combinations are appropriate to provide incentives for achievement of desired results for the

company. The base salary, together with the target bonus or “total cash compensation” for the named executive

officers, was approximately at or above the 50th percentile for similarly situated executive officers at comparable

companies.

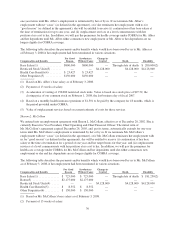

In March 2008, a similar process was undertaken by the Compensation Committee to establish a fiscal 2008

target bonus for all of the company’s named executive officers, including the Chief Executive Officer. After a

review of the respective responsibilities of the named executive officers, the current combinations of pay

elements for each named executive officer and whether such combinations are appropriate to create incentives to

achieve desired results for the company, the Compensation Committee determined that target bonuses as a

percentage of base salary would remain the same for the named executive officers, including our Chief Executive

Officer, in fiscal 2008 as in fiscal 2007.

What are the criteria considered in awarding annual incentives?

Under the 2001 Incentive Bonus Plan, key performance criteria for evaluating named executive officers,

including business and financial objectives and organizational goals, as well as other relevant factors, are

considered by the Compensation Committee with input from the Chief Executive Officer. For fiscal 2007, the

Compensation Committee determined that no portion of the total target bonus amount under the 2001 Incentive

Bonus Plan would be payable unless a prescribed company goal relating to company profitability (the “Company

Objective”) was achieved. No amount is payable under the 2001 Incentive Bonus Plan unless the Compensation

Committee first certifies that the Company Objective has been achieved.

For fiscal 2007, the Company Objective, as described above, was the sole criterion for payment of bonus

amounts under the 2001 Incentive Bonus Plan. The Compensation Committee believes that profitability is the

most significant measure of performance. The achievability of the Company Objective is deemed substantially

uncertain of attainment for purposes of Internal Revenue Code Section 162(m) because it is based on

profitability. When the Company Objective was established, however, it was reasonably attainable based upon

the company’s historic and expected levels of profitability. Once the Company Objective is achieved, the

maximum amount payable is then available for payment to executive officers, including named executive

officers, as fully deductible compensation. However, the Compensation Committee is permitted to apply negative

discretion in determining the actual amount to be paid to any executive officer. In determining how (or if) to

apply such negative discretion, the Compensation Committee measures company performance against the

business plan approved by the Board in the first fiscal quarter as well as individual performance.

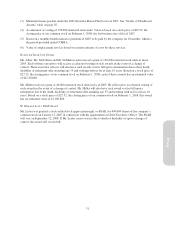

The Compensation Committee verifies the company’s actual earnings for each performance period, reviews

management’s recommendation for the resulting aggregate bonus awards and approves an aggregate award

amount. The Compensation Committee also reviews and approves the individual bonuses payable to each of the

company’s executive officers. The Chief Executive Officer approves the bonuses for all other eligible employees

below the executive officer level. The Compensation Committee decides the bonus amount for the Chief

Executive Officer in an executive session.

Although the Compensation Committee has certified that the Company Objective was achieved for fiscal 2007,

the company’s performance results did not fully meet either the company’s or the Compensation Committee’s

37

Proxy