Pottery Barn 2007 Annual Report Download - page 130

Download and view the complete annual report

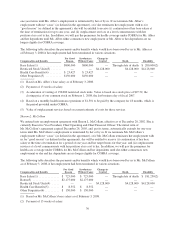

Please find page 130 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ongoing employment relationship with the company. The restricted stock units and any related dividend equivalents

are subject to forfeiture if the executive’s employment terminates prior to the end of the vesting period for any

reason other than death or disability, and, under those circumstances, a pro-rata share of the award would vest as the

executive would have performed some but not all of the services required under the award terms.

It has been and continues to be the company’s practice not to reprice stock options or SSARs in the event that the

fair market value of the common stock falls below the exercise price of the stock options or SSARs (or to engage

in any exchange program relating to stock options or SSARs) without obtaining prior shareholder approval. In

addition, our 2001 Long-Term Incentive Plan prohibits such repricings or exchanges unless our shareholders

approve them in advance. Currently, we have a large number of options and SSARs with exercise prices that

exceed the fair market value of our common stock.

When are equity awards made to executive officers?

Equity awards to executive officers are only approved at scheduled Compensation Committee meetings.

Executives do not have any role in selecting the grant date of equity awards. The grant date of equity awards is

generally the date of the approval of the award, and the exercise price of stock options or SSARs is always the

closing price of the company’s common stock on the trading day prior to the grant date. In general, equity awards

to named executive officers are made during the Compensation Committee’s March meeting in which the

Compensation Committee reviews company performance over the past fiscal year and determines base salaries

and bonuses for named executive officers. The Compensation Committee also makes equity awards at other

times during the year in connection with promotions, assumptions of additional responsibilities and other

considerations. No such off-cycle awards were made to the named executive officers in fiscal 2007. The

Compensation Committee does not time equity grants to take advantage of anticipated or actual changes in the

price of our common stock prior to or following the release of material information regarding the company.

Does the company have a stock ownership policy for its executive officers?

We do not currently have a stock ownership policy for our executive officers, but all of our named executive

officers own shares of the company’s common stock or vested, but unexercised, equity awards.

Does the company have a policy regarding recovery of past awards or payments in the event of a financial

restatement?

Although we do not currently have a formal policy regarding recovery of past awards or payments in the event of

a financial restatement, we support the review of performance-based compensation following a restatement that

impacts the achievement of performance targets relating to that compensation, followed by appropriate action.

These actions may include recoupment of cash or other incentives, as well as employment actions including

termination.

How is the Chief Executive Officer compensated?

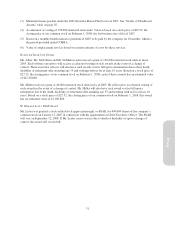

W. Howard Lester became Chief Executive Officer and Chairman of the Board as of July 14, 2006. Mr. Lester’s

fiscal 2007 compensation package was based on:

• A review of the compensation paid to chief executive officers of comparable companies (based on the

process described above);

• Company performance; and

• Our general compensation philosophy as described above.

Mr. Lester also makes personal use of our company aircraft as described in the “Other Annual Compensation

from Summary Compensation Table” on page 24. Mr. Lester received no other additional material compensation

or benefits not provided to all executives during fiscal 2007. Frederic W. Cook did not provide any advice

regarding Mr. Lester’s compensation in fiscal 2007.

40