Pottery Barn 2007 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

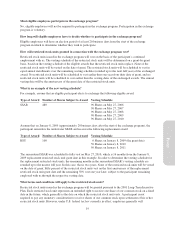

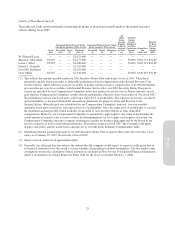

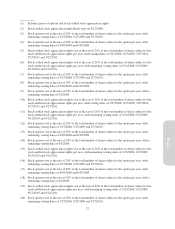

(21) Stock options vest at the rate of 20% of the total number of shares subject to the option per year, with

remaining vesting dates of 6/30/2008 and 6/30/2009.

(22) Stock options vest at the rate of 20% of the total number of shares subject to the option per year, with a

remaining vesting date of 6/4/2008.

(23) Stock-settled stock appreciation rights vest at the rate of 20% of the total number of shares subject to the

stock-settled stock appreciation rights per year, with vesting dates of 3/27/2008, 3/27/2009, 3/27/2010,

3/27/2011 and 3/27/2012.

(24) Stock-settled stock appreciation rights vest at the rate of 20% of the total number of shares subject to the

stock-settled stock appreciation rights per year, with remaining vesting dates of 9/12/2008, 9/12/2009,

9/12/2010 and 9/12/2011.

(25) Stock-settled stock appreciation rights vest at the rate of 20% of the total number of shares subject to the

stock-settled stock appreciation rights per year, with remaining vesting dates of 8/16/08, 8/16/2009 and

8/16/2010.

(26) Stock options vest at the rate of 20% of the total number of shares subject to the option per year, with

remaining vesting dates of 5/27/2008, 5/27/2009 and 5/27/2010.

(27) Stock options vest at the rate of 20% of the total number of shares subject to the option per year, with

remaining vesting dates of 6/30/2008 and 6/30/2009.

(28) Stock options vest at the rate of 20% of the total number of shares subject to the option per year, with a

remaining vesting date of 4/1/2008.

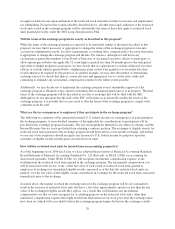

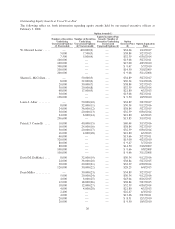

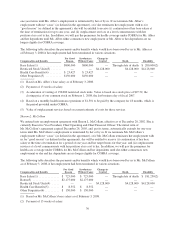

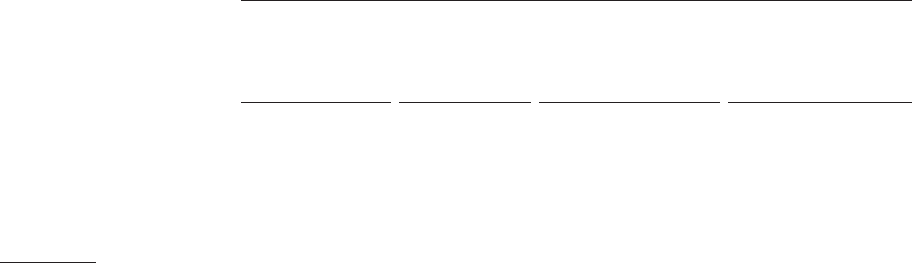

Stock Awards

Number of Shares or

Units of Stock that

have not Vested (#)(1)

Market Value of

Shares or Units of

Stock that have

not Vested ($)(1)(3)

Equity Incentive Plan

Awards: Number of

Unearned Shares, Units or

Other Rights that have

not Vested (#)(2)

Equity Incentive

Plan Awards:

Market or Payout Value of

Unearned Shares, Units

or Other Rights that have

not Vested ($)(2)(3)

W. Howard Lester ........ — — — —

Sharon L. McCollam ...... — — 150,000 $4,128,000

Laura J. Alber ........... — — 150,000 $4,128,000

Patrick J. Connolly ....... — — — —

David M. DeMattei ....... — — 150,000 $4,128,000

Dean Miller ............. 40,000 $1,100,800 — —

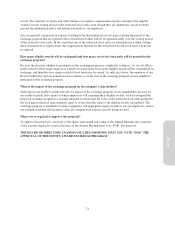

(1) Includes grant of restricted stock units. The restricted stock units vest in two equal annual installments on

January 31, 2010 and January 30, 2011. Mr. Miller will receive accelerated vesting of any restricted stock

units held by him in the event of a change of control. Mr. Miller’s award will vest in full upon a termination

due to his death, disability or retirement after attaining age 55 and working with us for at least 10 years.

(2) Includes grants of restricted stock units. The restricted stock units vest in two equal annual installments on

January 31, 2010 and January 30, 2011, subject to the company achieving certain performance goals.

Ms. McCollam, Ms. Alber and Mr. DeMattei will receive accelerated vesting of any restricted stock units

held by them in the event of a change of control. These awards will also vest in full upon the executive

officers’ termination due to their death, disability or retirement after attaining age 55 and working with us

for at least 10 years.

(3) Based on a stock price of $27.52, the closing price of our common stock on February 1, 2008, the last

business day of fiscal 2007.

28