Pottery Barn 2007 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

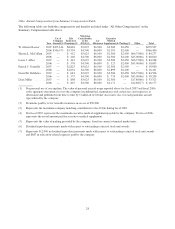

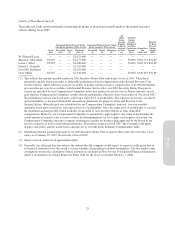

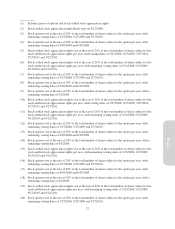

(3) Maximum bonus payable under the 2001 Incentive Bonus Plan for fiscal 2007. See “Grants of Plan-Based

Awards” table on page 25.

(4) Acceleration of vesting of 150,000 restricted stock units. Value is based on a stock price of $27.52, the

closing price of our common stock on February 1, 2008, the last business day of fiscal 2007.

(5) Based on a monthly health insurance premium of $465 to be paid by the company for 18 months, which is

the period provided under COBRA.

(6) Value of outplacement services based on current estimate of costs for these services.

Restricted Stock Unit Grants

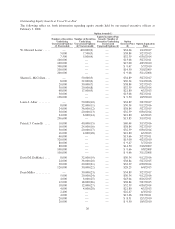

Ms. Alber, Ms. McCollam and Mr. DeMattei each received a grant of 150,000 restricted stock units in fiscal

2005. Each of these executives will receive accelerated vesting of such awards in the event of a change of

control. These executive officers will also have such awards vest in full upon a termination due to their death,

disability or retirement after attaining age 55 and working with us for at least 10 years. Based on a stock price of

$27.52, the closing price of our common stock on February 1, 2008, each of these awards has an estimated value

of $4,128,000.

Mr. Miller received a grant of 40,000 restricted stock units in fiscal 2005. He will receive accelerated vesting of

such awards in the event of a change of control. Mr. Miller will also have such award vest in full upon a

termination due to his death, disability or retirement after attaining age 55 and working with us for at least 10

years. Based on a stock price of $27.52, the closing price of our common stock on February 1, 2008, this award

has an estimated value of $1,100,800.

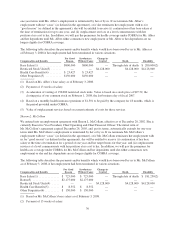

W. Howard Lester SSAR Award

Mr. Lester was granted a stock-settled stock appreciation right, or SSAR, for 400,000 shares of the company’s

common stock on January 12, 2007 in connection with his appointment as Chief Executive Officer. The SSAR

will vest on September 12, 2008. If Mr. Lester ceases service due to death or disability or upon a change of

control, the award will vest in full.

31

Proxy