Pottery Barn 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

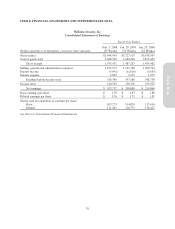

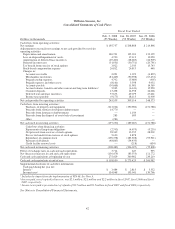

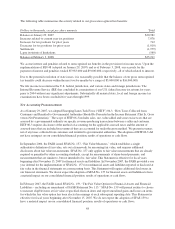

Williams-Sonoma, Inc.

Consolidated Statements of Shareholders’ Equity

Common Stock Additional

Paid-in

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Income

Total

Shareholders’

Equity

Comprehensive

IncomeDollars and shares in thousands Shares Amount

Balance at January 30, 2005 (52 Weeks) 115,372 $1,154 $286,720 $ 664,619 $ 5,169 $ 957,662

Net earnings — — — 214,866 — 214,866 $214,866

Foreign currency translation adjustment — — — — 2,526 2,526 2,526

Exercise of stock options

and related tax effect 1,829 18 43,727 — — 43,745

Repurchase and retirement

of common stock (2,422) (24) (5,741) (88,156) — (93,921)

Stock-based compensation expense — — 440 — — 440

Comprehensive income $217,392

Balance at January 29, 2006 (52 Weeks) 114,779 1,148 325,146 791,329 7,695 1,125,318

Net earnings — — — 208,868 — 208,868 $208,868

Foreign currency translation adjustment — — — — 76 76 76

Unrealized gain on investment — — — — 13 13 13

Exercise of stock options

and related tax effect 913 9 21,349 — — 21,358

Repurchase and retirement

of common stock (5,824) (58) (15,031) (170,419) — (185,508)

Stock-based compensation expense — — 26,759 54 — 26,813

Dividends declared — — — (45,507) — (45,507)

Comprehensive income $208,957

Balance at January 28, 2007 (52 Weeks) 109,868 1,099 358,223 784,325 7,784 1,151,431

Net earnings — — — 195,757 — 195,757 $195,757

Foreign currency translation adjustment — — — — 7,482 7,482 7,482

Unrealized loss on investment — — — — (15) (15) (15)

Exercise of stock options

and related tax effect 1,677 16 36,337 — — 36,353

Repurchase and retirement

of common stock (6,196) (61) (18,060) (172,257) — (190,378)

Stock-based compensation expense — — 26,717 60 — 26,777

Dividends declared — — — (50,000) — (50,000)

Adoption of FIN 48 1— — — (11,684) — (11,684)

Comprehensive income $203,224

Balance at February 3, 2008 (53 Weeks) 105,349 $1,054 $403,217 $ 746,201 $15,251 $1,165,723

1Represents the impact from the implementation of Financial Accounting Standards Board (“FASB”) Interpretation Number

(“FIN”) 48, “Accounting for Uncertainty in Income Taxes—an interpretation of FASB Statement No. 109.” See Note A.

See Notes to Consolidated Financial Statements.

41

Form 10-K