Pottery Barn 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

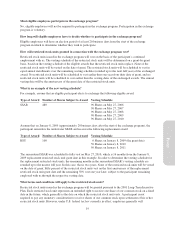

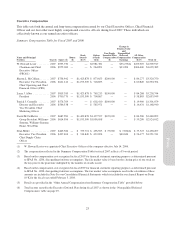

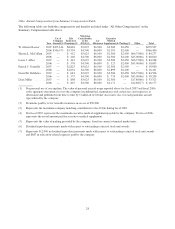

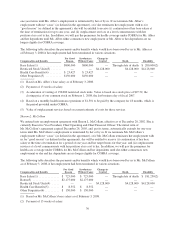

Grants of Plan-Based Awards

This table sets forth certain information regarding all grants of plan-based awards made to the named executive

officers during fiscal 2007.

Grant

Date

Estimated Future Payouts Under

Non-Equity Incentive Plan Awards

Estimated Future Payouts Under

Equity Incentive Plan Awards

All

Other

Stock

Awards;

Number

of Shares

of Stock

or Units

(#)

All Other

Option

Awards;

Number of

Securities

Underlying

Options

(#)(3)

Grant Date

Fair

Value ($)(4)

Exercise

or Base

Price of

Option

Awards

($/Sh)

Threshold

($)(1)

Target

($)

Maximum

($)(1)(2)

Threshold

($)

Target

($)

Maximum

($)

W. Howard Lester .... — — — $2,925,000 — — — — — — —

Sharon L. McCollam . . 3/27/07 — — $2,175,000 — — — — 50,000 $582,715 $34.89

Laura J. Alber ....... 3/27/07 — — $2,400,000 — — — — 50,000 $582,715 $34.89

Patrick J. Connolly . . . — — — $1,710,000 — — — — — — —

David M. DeMattei . . . — — — $2,025,000 — — — — — — —

Dean Miller ......... 3/27/07 — — $1,320,000 — — — — 30,000 $349,629 $34.89

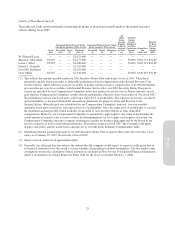

(1) This reflects the amounts payable under our 2001 Incentive Bonus Plan with respect to fiscal 2007. This plan is

intended to qualify bonus payments as deductible performance-based compensation under Internal Revenue Code

Section 162(m), which otherwise restricts our ability to deduct certain executive compensation to $1,000,000 million

per executive per year. In accordance with Internal Revenue Service rules, our 2001 Incentive Bonus Plan payout

criteria are specified by our Compensation Committee in the first quarter of each fiscal year. Bonus amounts are not

paid until the Compensation Committee certifies that the performance objectives have been achieved. For fiscal 2007,

the performance criteria was based upon achieving a target level of profitability. This target level, because it is based

upon profitability, is deemed substantially uncertain of attainment for purposes of Internal Revenue Code

Section 162(m). When the goal was established by our Compensation Committee, however, it was reasonably

attainable based upon our historic and expected levels of profitability. Once the target level of profitability is reached,

the maximum amount payable is then available for payment to our executive officers as fully deductible

compensation. However, our Compensation Committee is permitted to apply negative discretion in determining the

actual amount to be paid to any executive officer. In determining how (or if) to apply such negative discretion, our

Compensation Committee measures company performance against the business plan approved by the Board in our

first fiscal quarter as well as individual performance. For bonuses earned in fiscal 2007, the Committee did apply

negative discretion, and the actual bonus amounts are as set forth in the Summary Compensation Table.

(2) Maximum potential payment pursuant to our 2001 Incentive Bonus Plan is equal to three times the executive’s base

salary as of January 29, 2007, the first day of fiscal 2007.

(3) Grants of stock-settled stock appreciation rights.

(4) Generally, the full grant date fair value is the amount that the company would expect to expense on the grant date in

its financial statements over the award’s vesting schedule, disregarding forfeiture assumptions. The fair market value

assumptions used in the calculation of these amounts are included in Note I to our Consolidated Financial Statements

which is included in our Annual Report on Form 10-K for the fiscal year ended February 3, 2008.

25

Proxy