Pottery Barn 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

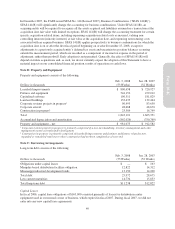

collateralized by the distribution facility and require us to maintain certain financial covenants. As of February 3,

2008, $11,893,000 was outstanding under the Partnership 2 industrial development bonds.

We made annual rental payments of approximately $2,591,000, $2,585,000 and $2,600,000 plus applicable taxes,

insurance and maintenance expenses in fiscal 2007, fiscal 2006 and fiscal 2005, respectively. Although the

current term of the lease expires in August 2008, we are obligated to renew the operating lease on an annual basis

until these bonds are fully repaid.

The two partnerships described above qualify as variable interest entities under FIN 46R due to their related

party relationship to us and our obligation to renew the leases until the bonds are fully repaid. Accordingly, the

two related party variable interest entity partnerships from which we lease our Memphis-based distribution

facilities are consolidated by us. As of February 3, 2008, our consolidated balance sheet includes $16,995,000 in

assets (primarily buildings), $12,822,000 in debt and $4,173,000 in other long-term liabilities. Consolidation of

these partnerships does not have an impact on our net income.

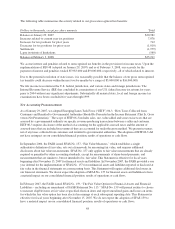

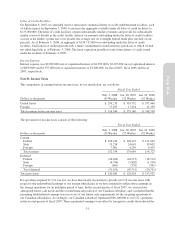

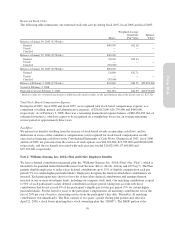

Note G: Earnings Per Share

The following is a reconciliation of net earnings and the number of shares used in the basic and diluted earnings

per share computations:

Dollars and amounts in thousands, except per share amounts

Net

Earnings

Weighted

Average Shares

Per-Share

Amount

2007 (53 Weeks)

Basic $195,757 109,273 $1.79

Effect of dilutive stock-based awards 2,174

Diluted $195,757 111,447 $1.76

2006 (52 Weeks)

Basic $208,868 114,020 $1.83

Effect of dilutive stock-based awards 2,753

Diluted $208,868 116,773 $1.79

2005 (52 Weeks)

Basic $214,866 115,616 $1.86

Effect of dilutive stock-based awards 2,811

Diluted $214,866 118,427 $1.81

Stock-based awards of 5,612,000, 4,181,000 and 320,000 in fiscal 2007, fiscal 2006 and fiscal 2005 respectively,

were not included in the computation of diluted earnings per share, as their inclusion would be anti-dilutive.

Note H: Common Stock

Authorized preferred stock consists of 7,500,000 shares at $0.01 par value of which none was outstanding during

fiscal 2007 or fiscal 2006. Authorized common stock consists of 253,125,000 shares at $0.01 par value. Common

stock outstanding at the end of fiscal 2007 and fiscal 2006 was 105,349,000 and 109,868,000 shares,

respectively. Our Board of Directors is authorized to issue equity awards for up to the total number of shares

authorized and remaining available for grant under our 2001 Amended and Restated Long-Term Incentive Plan.

During fiscal 2007, we repurchased and retired a total of 6,195,500 shares of common stock completing all

programs previously authorized, at a weighted average cost of $30.73 per share and an aggregate cost of

approximately $190,378,000.

In January 2008, our Board of Directors authorized the repurchase of up to an additional $150,000,000 of our common

stock through open market and privately negotiated transactions, at times and in such amounts as management deems

appropriate. The timing and actual number of shares repurchased will depend on a variety of factors including price,

corporate and regulatory requirements, capital availability and other market conditions. The stock repurchase program

does not have an expiration date and may be limited or terminated at any time without prior notice.

54