Pottery Barn 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

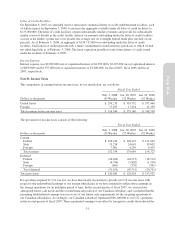

Advertising and Prepaid Catalog Expenses

Advertising expenses consist of media and production costs related to catalog mailings, e-commerce advertising

and other direct marketing activities. All advertising costs are expensed as incurred with the exception of prepaid

catalog expenses. Prepaid catalog expenses consist primarily of third party incremental direct costs, including

creative design, paper, printing, postage and mailing costs for all of our direct response catalogs. Such costs are

capitalized as prepaid catalog expenses and are amortized over their expected period of future benefit. Such

amortization is based upon the ratio of actual revenues to the total of actual and estimated future revenues on an

individual catalog basis. Estimated future revenues are based upon various factors such as the total number of

catalogs and pages circulated, the probability and magnitude of consumer response and the assortment of

merchandise offered. Each catalog is generally fully amortized over a six to nine month period, with the majority

of the amortization occurring within the first four to five months. Prepaid catalog expenses are evaluated for

realizability on a monthly basis by comparing the carrying amount associated with each catalog to the estimated

probable remaining future profitability (remaining net revenues less merchandise cost of goods sold, selling

expenses and catalog related-costs) associated with that catalog. If the catalog is not expected to be profitable, the

carrying amount of the catalog is impaired accordingly.

Total advertising expenses (including catalog advertising, e-commerce advertising and all other advertising

costs) were approximately $379,468,000, $365,829,000 and $346,620,000 in fiscal 2007, fiscal 2006 and fiscal

2005, respectively.

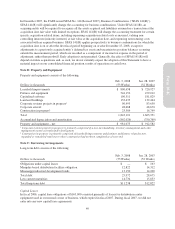

Property and Equipment

Property and equipment is stated at cost. Depreciation is computed using the straight-line method over the

estimated useful lives of the assets below. Any reduction in the estimated useful lives would result in higher

depreciation expense in a given period for the related assets.

Leasehold improvements Shorter of estimated useful life or lease term (generally 3 – 22 years)

Fixtures and equipment 2 – 20 years

Buildings and building improvements 10 – 40 years

Capitalized software 2 – 10 years

Corporate aircraft 20 years (20% salvage value)

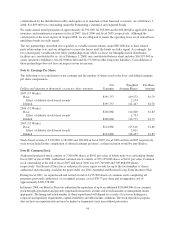

Internally developed software costs are capitalized in accordance with the American Institute of Certified Public

Accountants Statement of Position (“SOP”) 98-1, “Accounting for the Costs of Computer Software Developed or

Obtained for Internal Use.”

Interest costs related to assets under construction, including software projects, are capitalized during the

construction or development period. We capitalized interest costs of $1,389,000, $699,000 and $1,200,000 in

fiscal 2007, fiscal 2006 and fiscal 2005, respectively.

For any store closures where a lease obligation still exists, we record the estimated future liability associated with

the rental obligation on the date the store is closed, however, most store closures occur upon the lease expiration.

We review the carrying value of all long-lived assets for impairment whenever events or changes in

circumstances indicate that the carrying value of an asset may not be recoverable. We review for impairment all

stores for which current cash flows from operations are either negative or nominal, or the construction costs are

significantly in excess of the amount originally expected. Impairment results when the carrying value of the

assets exceeds the undiscounted future cash flows over the life of the lease. Our estimate of undiscounted future

cash flows over the lease term (typically 5 to 22 years) is based upon our experience, historical operations of the

stores and estimates of future store profitability and economic conditions. The future estimates of store

profitability and economic conditions require estimating such factors as sales growth, employment rates, lease

escalations, inflation on operating expenses and the overall economics of the retail industry for up to 20 years in

the future, and are therefore subject to variability and difficult to predict. If a long-lived asset is found to be

impaired, the amount recognized for impairment is equal to the difference between the net carrying value and the

44