Pottery Barn 2007 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

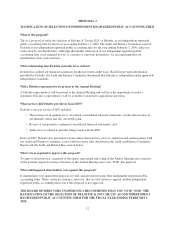

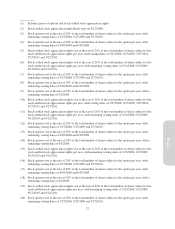

Must eligible employees participate in the exchange program?

No, eligible employees will not be required to participate in the exchange program. Participation in the exchange

program is voluntary.

How long will eligible employees have to decide whether to participate in the exchange program?

Eligible employees will have an election period of at least 20 business days from the start of the exchange

program in which to determine whether they wish to participate.

How will restricted stock units granted in connection with the exchange program vest?

Restricted stock units issued in the exchange program will vest on the basis of the participant’s continued

employment with us. The vesting schedule of the restricted stock units will be determined on a grant-by-grant

basis, based on the vesting schedule of the eligible awards that the restricted stock units replace. None of the

restricted stock units will be vested on the date of grant. The restricted stock units will be scheduled to vest in

equal annual installments over the remaining vesting schedule (rounded up to the next full year) of the exchanged

award. No restricted stock units will be scheduled to vest earlier than one year from their date of grant, and no

restricted stock units will be scheduled to vest earlier than the vesting dates of the exchanged awards. The annual

vesting date will be the anniversary of the grant date of the restricted stock units.

What is an example of the new vesting schedule?

For example, assume that an eligible participant elects to exchange the following eligible award:

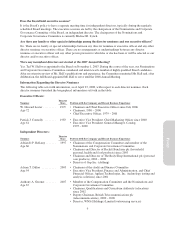

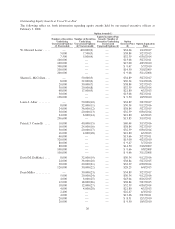

Type of Award Number of Shares Subject to Award Vesting Schedule

SSAR 480 96 Shares on May 27, 2006

96 Shares on May 27, 2007

96 Shares on May 27, 2008

96 Shares on May 27, 2009

96 Shares on May 27, 2010

Assume that on January 8, 2009 (approximately 20 business days after the start of the exchange program), the

participant surrenders the underwater SSAR and receives the following replacement award:

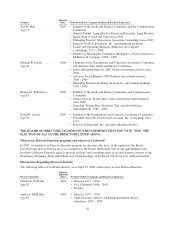

Type of Award Number of Shares Subject to Award Vesting Schedule

RSU 100 0 Shares on January 8, 2009 (the grant date)

50 Shares on January 8, 2010

50 Shares on January 8, 2011

The surrendered SSAR was scheduled to fully vest on May 27, 2010, which is 16 months from the January 8,

2009 replacement restricted stock unit grant date in this example. In order to determine the vesting schedule for

the replacement restricted stock units, the remaining months in the surrendered SSAR’s vesting schedule are

rounded up to the nearest full year. In this case, that is two years. None of the restricted stock units will be vested

on the date of grant. Fifty percent of the restricted stock units vest on the first anniversary of the replacement

restricted stock unit grant date and the remaining 50% vest one year later, subject to the participant remaining

employed with us through the respective vesting date.

What terms and conditions will apply to the restricted stock units?

Restricted stock units issued in the exchange program will be granted pursuant to the 2001 Long-Term Incentive

Plan. Each restricted stock unit represents an unfunded right to receive one share of our common stock on a fixed

date in the future, which generally is the date on which the restricted stock unit vests. A participant is not

required to pay any monetary consideration to receive shares of our common stock upon settlement of his or her

restricted stock units. However, under U.S. federal tax law currently in effect, employees generally will

19

Proxy