Pottery Barn 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

financial tax liability associated with this foreign dividend to zero. The accumulated remaining undistributed

earnings of all of our foreign subsidiaries were approximately $9,500,000 as of February 3, 2008 and are

sufficient to support our anticipated future cash needs for our foreign operations. We currently intend to utilize

the remainder of these undistributed earnings for an indefinite period of time and will only repatriate such

earnings when it is tax effective to do so. It is currently not practical to estimate the tax liability that might be

payable if these foreign earnings were to be repatriated.

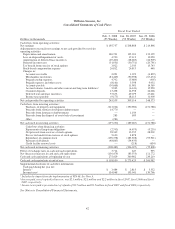

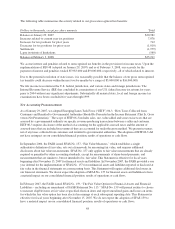

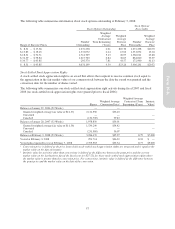

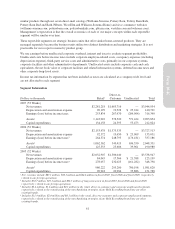

A reconciliation of income taxes at the federal statutory corporate rate to the effective rate is as follows:

Fiscal Year Ended

Feb. 3, 2008

(53 Weeks)

Jan. 28, 2007

(52 Weeks)

Jan. 29, 2006

(52 Weeks)

Federal income taxes at the statutory rate 35.0% 35.0% 35.0%

State income tax rate and other, less federal benefit 3.1% 3.1% 3.4%

Total 38.1% 38.1% 38.4%

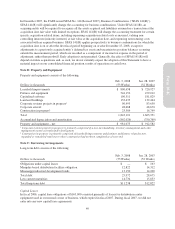

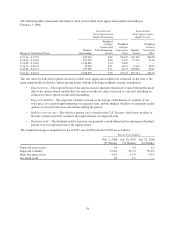

Significant components of our deferred tax accounts are as follows:

Dollars in thousands

Feb. 3, 2008

(53 Weeks)

Jan. 28, 2007

(52 Weeks)

Current:

Compensation $ 11,392 $ 11,977

Inventory 22,117 16,210

Accrued liabilities 17,585 16,821

Customer deposits 61,215 47,969

Deferred catalog costs (21,184) (22,878)

Other 718 738

Total current 91,843 70,837

Non-current:

Depreciation 14,616 11,803

Deferred rent 12,390 10,718

Stock-based compensation 17,757 9,972

Deferred lease incentives (23,046) (20,070)

Executive deferral plan 6,214 5,113

State taxes 15,985 —

Other 1,081 1,134

Total non-current 44,997 18,670

Total deferred tax assets, net $136,840 $ 89,507

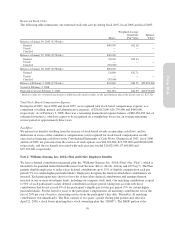

Note E: Accounting for Leases

Operating Leases

We lease store locations, warehouses, corporate facilities, call centers and certain equipment for original terms

ranging generally from 3 to 22 years. Certain leases contain renewal options for periods up to 20 years. The

rental payment requirements in our store leases are typically structured as either minimum rent, minimum rent

plus additional rent based on a percentage of store sales if a specified store sales threshold is exceeded, or rent

based on a percentage of store sales if a specified store sales threshold or contractual obligations of the landlord

has not been met. Contingent rental payments, including rental payments that are based on a percentage of sales,

cannot be predicted with certainty at the onset of the lease term. Accordingly, any contingent rental payments are

recorded as incurred each period when the sales threshold is probable and are excluded from our calculation of

deferred rent liability. See Note A.

52