Pottery Barn 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

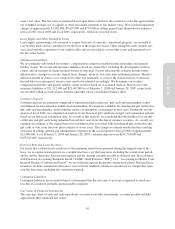

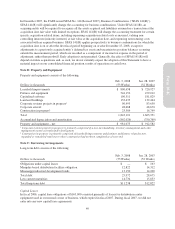

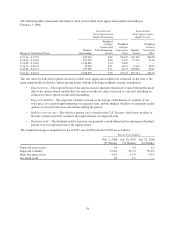

Total rental expense for all operating leases was as follows:

Fiscal Year Ended

Dollars in thousands

Feb. 3, 2008

(53 Weeks)

Jan. 28, 2007

(52 Weeks)

Jan. 29, 2006

(52 Weeks)

Minimum rent expense $146,226 $130,870 $119,440

Contingent rent expense 35,731 35,020 33,529

Less: sublease rental income (46) (39) (62)

Total rent expense $181,911 $165,851 $152,907

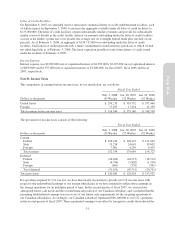

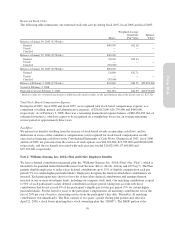

The aggregate minimum annual rental payments under noncancelable operating leases (excluding the Memphis-

based distribution facilities) in effect at February 3, 2008 were as follows:

Dollars in thousands

Minimum Lease

Commitments1

Fiscal 2008 $ 214,502

Fiscal 2009 210,168

Fiscal 2010 198,564

Fiscal 2011 180,600

Fiscal 2012 164,939

Thereafter 763,326

Total $ 1,732,099

1Projected payments include only those amounts that are fixed and determinable as of the reporting date. We currently pay

rent for certain store locations based on a percentage of store sales if a specified store sales threshold or contractual

obligations of the landlord has not been met. Projected payments for these locations are based on minimum rent, as future

store sales cannot be predicted with certainty.

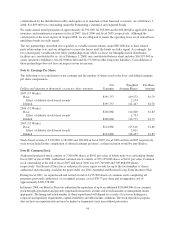

Note F: Consolidation of Memphis-Based Distribution Facilities

Our Memphis-based distribution facilities include an operating lease entered into in July 1983 for a distribution

facility in Memphis, Tennessee. The lessor is a general partnership (“Partnership 1”) comprised of W. Howard

Lester, our Chairman of the Board of Directors and Chief Executive Officer and James A. McMahan, a Director

Emeritus, both of whom are significant shareholders. Partnership 1 does not have operations separate from the

leasing of this distribution facility and does not have lease agreements with any unrelated third parties.

Partnership 1 financed the construction of this distribution facility through the sale of a total of $9,200,000 of

industrial development bonds in 1983 and 1985. Annual principal payments and monthly interest payments are

required through maturity in December 2010. The Partnership 1 industrial development bonds are collateralized

by the distribution facility and the individual partners guarantee the bond repayments. As of February 3, 2008,

$929,000 was outstanding under the Partnership 1 industrial development bonds.

We made annual rental payments in fiscal 2007, fiscal 2006 and fiscal 2005 of approximately $618,000, plus

interest on the bonds calculated at a variable rate determined monthly (approximately 3.4% on February 3, 2008),

applicable taxes, insurance and maintenance expenses. Although the current term of the lease expires in August

2008, we are obligated to renew the operating lease on an annual basis until these bonds are fully repaid.

Our other Memphis-based distribution facility includes an operating lease entered into in August 1990 for

another distribution facility that is adjoined to the Partnership 1 facility in Memphis, Tennessee. The lessor is a

general partnership (“Partnership 2”) comprised of W. Howard Lester, James A. McMahan and two unrelated

parties. Partnership 2 does not have operations separate from the leasing of this distribution facility and does not

have lease agreements with any unrelated third parties.

Partnership 2 financed the construction of this distribution facility and related addition through the sale of a total

of $24,000,000 of industrial development bonds in 1990 and 1994. Quarterly interest and annual principal

payments are required through maturity in August 2015. The Partnership 2 industrial development bonds are

53

Form 10-K