Pottery Barn 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.What are the material terms of the exchange program?

The material terms of the exchange program include eligibility, the exchange ratios to be applied to eligible

awards and the vesting schedule to apply to restricted stock units issued pursuant to the exchange program. These

terms are summarized in the following questions and answers, and described in further detail below.

Who will be eligible to participate in the exchange program?

If approved by the shareholders, the exchange program will be open to all United States-based employees, except

as described below, who are employed by us as of the start of the exchange program and remain employees

through the date the exchange program ends. Certain additional eligibility criteria are discussed further below.

Who will not be eligible to participate in the exchange program?

The members of our Board of Directors and our named executive officers as of the start of the exchange program

will not be eligible to participate in the exchange program. In addition, employees based outside of the United

States will not be eligible to participate in the exchange program.

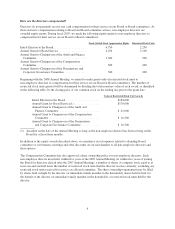

How will the exchange ratios be determined?

As described in further detail below, the exchange ratios of shares subject to eligible awards surrendered to

restricted stock units issued will be determined in a manner intended to result in the issuance of restricted stock

units that have a fair value approximately equal to, or less than, the fair value of the eligible awards they replace.

The exchange ratios will be established shortly before the start of the exchange program and will depend on the

original exercise price of the eligible award and the then current fair value of the award (calculated using a

Black-Scholes model), as described further below. The exchange program will not be a one-for-one exchange.

Instead, the participants will receive restricted stock units covering a lesser number of shares than are covered by

the exchanged eligible awards. The exchange ratios will be established by grouping together eligible awards with

similar exercise prices and assigning an appropriate exchange ratio to each grouping.

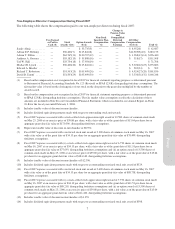

How will the restricted stock units vest?

Each restricted stock unit issued in the exchange program will represent a right to receive one share of our

common stock on a specified future date if the restricted stock unit vests during the participant’s continued

employment. None of the restricted stock units will be vested on the date of grant. The restricted stock units will

be subject to a new vesting schedule, determined on a grant-by-grant basis, based on the vesting schedule of the

eligible awards that the restricted stock units replace. As described in further detail below, the restricted stock

units will be scheduled to vest on an annual basis and will vest ratably over the remaining vesting schedule

(rounded up to the next full year) of the exchanged award. No restricted stock units will be scheduled to vest

earlier than one-year from their date of grant, and no restricted stock units will be scheduled to vest earlier than

the vesting dates of the exchanged awards. The annual vesting date will be the anniversary of the date of grant of

the restricted stock units.

When will the exchange program begin?

If approved by shareholders, the exchange program will begin within 12 months of the date shareholders approve

the program. Within this timeframe, the actual start date will be determined by the company. However, even if

the shareholders approve the proposal, the company may later determine not to implement the exchange

program. If the exchange program does not commence within 12 months of shareholder approval, the company

will consider any exchange program to be a new one, requiring new shareholder approval.

14