Pottery Barn 2004 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

What are the criteria considered in awarding annual incentives?

Under the 2001 Incentive Bonus Plan, key performance criteria for evaluating executive officers include business

and financial objectives, and people and organizational goals, as well as other relevant factors as determined by

us with input from the company’s senior management. These criteria change from year to year. For fiscal 2004,

the Compensation Committee determined that no portion of the total target bonus amount under the 2001

Incentive Bonus Plan would be payable unless a prescribed company goal relating to company profitability (the

“Company Objective”) was achieved.

In the first quarter of each fiscal year, we review a performance report that summarizes management’s view

regarding whether, and to what extent, the key performance criteria were attained for the prior fiscal year. The

performance report also discusses any other significant but unforeseen factors that may have positively or

negatively affected the company’s performance.

For fiscal 2004, the company exceeded the Company Objective and, as a result, full target bonus amounts were

paid pursuant to the 2001 Incentive Bonus Plan. Since the performance levels of the executive officers and the

company exceeded the company’s targeted goals, the Compensation Committee granted additional bonuses on a

discretionary basis outside of the 2001 Incentive Bonus Plan to the company’s executive officers reflecting each

such officer’s contribution to the company’s financial results for fiscal 2004.

We verify the company’s actual earnings for each performance period, review management’s recommendation

for the resulting aggregate bonus awards and approve an aggregate award amount. We also review and approve

the individual bonus recommendations for the company’s executive officers. The company’s Chief Executive

Officer approves the bonus recommendations for all other eligible employees below the executive officer level.

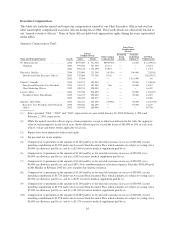

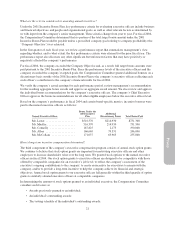

Based on the company’s performance in fiscal 2004 and certain brand-specific metrics, incentive bonuses were

paid to the named executive officers as follows:

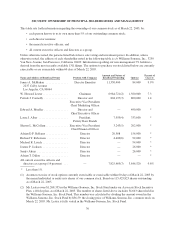

Named Executive Officer

Bonus Under the

2001 Incentive

Plan

Additional

Discretionary Bonus Total Bonus Paid

Mr. Lester .................... $516,370 $214,930 $731,300

Mr. Mueller ................... 516,370 214,930 731,300

Mr. Connolly ................. 187,825 2,175 190,000

Ms. Alber .................... 166,669 79,331 246,000

Ms. McCollam ................ 171,037 63,963 235,000

How is long-term incentive compensation determined?

The third component of the company’s executive compensation program consists of annual stock option grants.

We continue to believe that stock option grants are important for motivating executive officers and other

employees to increase shareholder value over the long term. We granted stock options to the named executive

officers in fiscal 2004. Our stock option grants to executive officers are designed to be competitive with those

offered by comparable companies for an executive’s job level, to reflect the company’s assessment of the

executive’s ongoing contributions to the company, to create an incentive for executives to remain with the

company, and/or to provide a long-term incentive to help the company achieve its financial and strategic

objectives. Annual stock option grants to our executive officers fall generally within the third quartile of option

grants to similarly situated executive officers at comparable companies.

In determining the amount of stock options granted to an individual executive, the Compensation Committee

considers such factors as:

• Awards previously granted to an individual;

• An individual’s outstanding awards;

• The vesting schedule of the individual’s outstanding awards;

21

Proxy