Pottery Barn 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

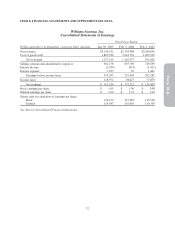

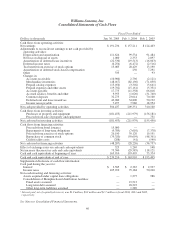

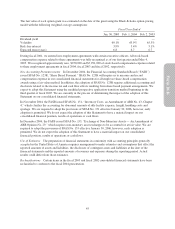

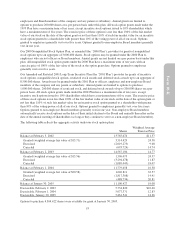

Note B: Property and Equipment

Property and equipment consist of the following:

Dollars in thousands Jan. 30, 2005 Feb. 1, 2004

Leasehold improvements1$ 600,249 $ 511,089

Fixtures and equipment2398,826 345,060

Land and buildings2131,471 131,341

Capitalized software 132,614 111,386

Corporate systems projects in progress377,077 54,585

Corporate aircraft 48,618 36,980

Construction in progress48,063 22,183

Capital leases 11,920 11,920

Total 1,408,838 1,224,544

Accumulated depreciation and amortization2(556,426) (459,514)

Property and equipment — net $ 852,412 $ 765,030

1Includes approximately $17.4 million of leasehold improvements related to our lease accounting adjustment. See Note E.

2Includes approximately $28.4 million of land and buildings and $1.5 million of fixtures and equipment at January 30, 2005

and February 1, 2004 and $11.1 million and $10.4 million of related accumulated depreciation at January 30, 2005 and

February 1, 2004, respectively, due to the consolidation of our Memphis-based distribution facilities. See Note F.

3Corporate systems projects in progress is primarily comprised of a new merchandising, inventory management and order

management system currently under development.

4Construction in progress is primarily comprised of leasehold improvements and furniture and fixtures related to new,

unopened retail stores.

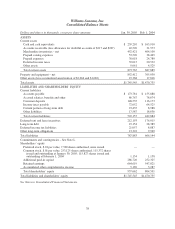

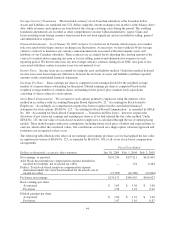

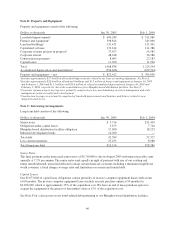

Note C: Borrowing Arrangements

Long-term debt consists of the following:

Dollars in thousands Jan. 30, 2005 Feb. 1, 2004

Senior notes $ 5,716 $11,430

Obligations under capital leases 5,673 7,724

Memphis-based distribution facilities obligation 17,000 18,223

Industrial development bonds 14,200 —

Total debt 42,589 37,377

Less current maturities 23,435 8,988

Total long-term debt $19,154 $28,389

Senior Notes

The final payment on the unsecured senior notes of $5,716,000 is due in August 2005 with interest payable semi-

annually at 7.2% per annum. The senior notes rank equally in right of payment with any of our existing and

future unsubordinated, unsecured debt and contain certain financial covenants including a minimum tangible net

worth covenant, a fixed charge coverage ratio and limitations on current and funded debt.

Capital Leases

Our $5,673,000 of capital lease obligations consist primarily of in-store computer equipment leases with a term

of 60 months. The in-store computer equipment leases include an early purchase option at 54 months for

$2,496,000, which is approximately 25% of the acquisition cost. We have an end of lease purchase option to

acquire the equipment at the greater of fair market value or 15% of the acquisition cost.

See Note F for a discussion on our bond-related debt pertaining to our Memphis-based distribution facilities.

46