Pottery Barn 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

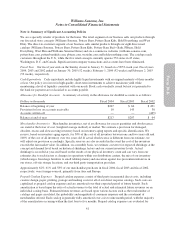

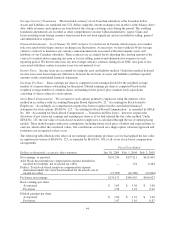

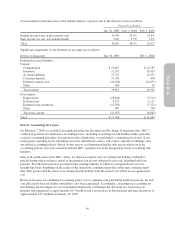

A reconciliation of income taxes at the federal statutory corporate rate to the effective rate is as follows:

Fiscal Year Ended

Jan. 30, 2005 Feb. 1, 2004 Feb. 2, 2003

Federal income taxes at the statutory rate 35.0% 35.0% 35.0%

State income tax rate, less federal benefit 3.4% 3.5% 3.5%

Total 38.4% 38.5% 38.5%

Significant components of our deferred tax accounts are as follows:

Dollars in thousands Jan. 30, 2005 Feb. 1, 2004

Deferred tax asset (liability)

Current:

Compensation $ 14,667 $ 12,587

Inventory 11,357 10,357

Accrued liabilities 13,725 11,971

Customer deposits 19,342 470

Deferred catalog costs (20,540) (14,871)

Other 464 18

Total current 39,015 20,532

Non-current:

Depreciation (18,634) (3,511)

Deferred rent 8,275 1,151

Deferred lease incentives (11,595) (7,271)

Other 897 744

Total non-current (21,057) (8,887)

Total $ 17,958 $ 11,645

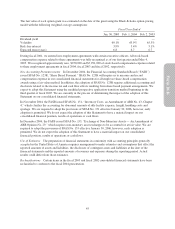

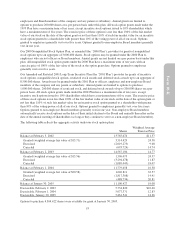

Note E: Accounting for Leases

On February 7, 2005, in a publicly disseminated letter, the Securities and Exchange Commission (the “SEC”)

clarified its position on certain lease accounting issues, including accounting for rent holidays under generally

accepted accounting principles. In response to this clarification, we performed a comprehensive review of our

real property operating leases (including our stores, distribution centers, call centers, and office buildings) and

our related accounting policies. Based on this review, we determined that the only area in which our lease

accounting policies were not consistent with the SEC’s position was in the recognition of rent cost during rent

holidays.

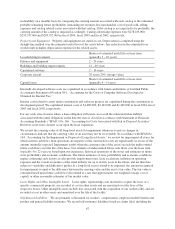

Prior to the publication of the SEC’s letter, we did not recognize rent cost during rent holidays (defined as

periods during which we have control of the premises but are not obligated to pay rent, including build-out

periods). We followed a practice prevalent in the retailing industry in which we recognized rent cost on a

straight-line basis, beginning on the earlier of the operations commencement date or the rent commencement

date. This practice had the effect of excluding the rent holiday from the period over which we recognized rent

cost.

However, because our established accounting policy was to capitalize rent paid during build-out periods, the rent

cost allocated to the rent holiday should have also been capitalized. Accordingly, correcting our accounting for

rent holidays had no impact on our Consolidated Statements of Earnings but did result in a net increase in

property and equipment of approximately $17.4 million and a net increase in deferred rent and lease incentives of

approximately $17.4 million at January 30, 2005.

49

Form 10-K