Pottery Barn 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Accordingly, the two related party variable interest entity partnerships from which we lease our Memphis-based

distribution facilities were consolidated by us as of February 1, 2004. As of January 30, 2005, the consolidation

had resulted in increases to our consolidated balance sheet of $18,882,000 in assets (primarily buildings),

$17,000,000 in long-term debt, and $1,882,000 in other long-term liabilities. Consolidation of these partnerships

did not have an impact on our net income. However, the interest expense associated with the partnerships’ long-

term debt, shown as occupancy expense in fiscal 2003, is now recorded as interest expense. In fiscal 2004, this

interest expense approximated $1,525,000.

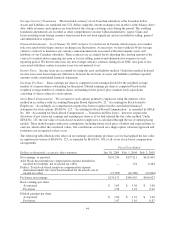

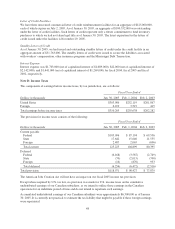

Note G: Earnings Per Share

The following is a reconciliation of net earnings and the number of shares used in the basic and diluted earnings

per share computations:

Dollars and amounts in thousands, except per share amounts

Net

Earnings

Weighted

Average Shares

Per-Share

Amount

2004

Basic $191,234 116,159 $1.65

Effect of dilutive stock options — 3,188

Diluted $191,234 119,347 $1.60

2003

Basic $157,211 115,583 $1.36

Effect of dilutive stock options — 3,433

Diluted $157,211 119,016 $1.32

2002

Basic $124,403 115,100 $1.08

Effect of dilutive stock options — 4,450

Diluted $124,403 119,550 $1.04

Options with an exercise price greater than the average market price of common shares for the period were

196,000 in fiscal 2004, 436,000 in fiscal 2003 and 1,414,000 in fiscal 2002 and were not included in the

computation of diluted earnings per share, as their inclusion would be anti-dilutive.

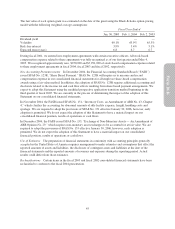

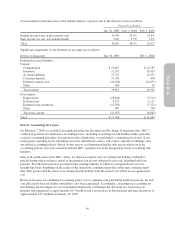

Note H: Common Stock

Authorized preferred stock consists of 7,500,000 shares of which none was outstanding during fiscal 2004 or

fiscal 2003. Authorized common stock consists of 253,125,000 shares at $0.01 par value. Common stock

outstanding at the end of fiscal 2004 and fiscal 2003 was 115,372,000 and 115,827,000 shares, respectively. The

Board of Directors is authorized to issue stock options for up to the total number of shares authorized and

remaining available for grant under each plan.

In May 2004, the Board of Directors authorized a stock repurchase program to acquire up to 2,500,000 shares of

our outstanding common stock. During fiscal 2004, we repurchased and retired 2,057,700 shares of our common

stock under this program, in addition to 215,000 shares under our previously authorized stock repurchase

program, at a total cost of approximately $79,320,000, a weighted average cost of $34.90 per share. As of year-

end, the remaining authorized number of shares eligible for repurchase was 442,300 shares. Stock repurchases

under this program may be made through open market and privately negotiated transactions at times and in such

amounts as management deems appropriate. The timing and actual number of shares repurchased will depend on

a variety of factors including price, corporate and regulatory requirements and other market conditions. The stock

repurchase program does not have an expiration date and may be limited or terminated at any time without prior

notice.

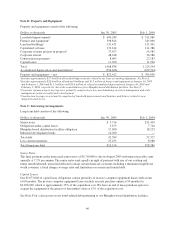

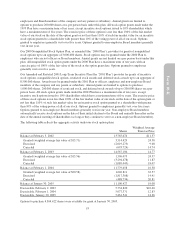

Note I: Stock Options

Our 1993 Stock Option Plan, as amended (the “1993 Plan”), provides for grants of incentive and nonqualified

stock options up to an aggregate of 17,000,000 shares. Stock options may be granted under the 1993 Plan to key

52