Pottery Barn 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

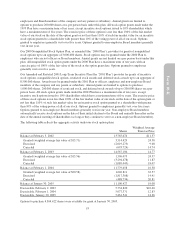

employees and Board members of the company and any parent or subsidiary. Annual grants are limited to

options to purchase 200,000 shares on a per person basis under this plan. All stock option grants made under the

1993 Plan have a maximum term of ten years, except incentive stock options issued to 10% shareholders which

have a maximum term of five years. The exercise price of these options is not less than 100% of the fair market

value of our stock on the date of the option grant or not less than 110% of such fair market value for an incentive

stock option granted to a shareholder with greater than 10% of the voting power of all of our stock. Options

granted to employees generally vest over five years. Options granted to non-employee Board members generally

vest in one year.

Our 2000 Nonqualified Stock Option Plan, as amended (the “2000 Plan”), provides for grants of nonqualified

stock options up to an aggregate of 3,000,000 shares. Stock options may be granted under the 2000 Plan to

employees who are not officers or Board members. Annual grants are not limited on a per person basis under this

plan. All nonqualified stock option grants under the 2000 Plan have a maximum term of ten years with an

exercise price of 100% of the fair value of the stock at the option grant date. Options granted to employees

generally vest over five years.

Our Amended and Restated 2001 Long-Term Incentive Plan (the “2001 Plan”) provides for grants of incentive

stock options, nonqualified stock options, restricted stock awards and deferred stock awards up to an aggregate of

8,500,000 shares. Awards may be granted under the 2001 Plan to officers, employee and non-employee Board

members of the company and any parent or subsidiary. Annual grants are limited to options to purchase

1,000,000 shares, 200,000 shares of restricted stock, and deferred stock awards of up to 200,000 shares on a per

person basis. All stock option grants made under the 2001 Plan have a maximum term of ten years, except

incentive stock options issued to 10% shareholders which have a maximum term of five years. The exercise price

of these stock options is not less than 100% of the fair market value of our stock on the date of the option grant or

not less than 110% of such fair market value for an incentive stock option granted to a shareholder with greater

than 10% of the voting power of all of our stock. Options granted to employees generally vest over five years.

Options granted to non-employee Board members generally vest in one year. Non-employee Board members

automatically receive stock options on the date of their initial election to the Board and annually thereafter on the

date of the annual meeting of shareholders (so long as they continue to serve as a non-employee Board member).

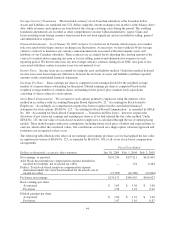

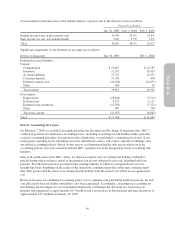

The following table reflects the aggregate activity under our stock option plans:

Shares

Weighted Average

Exercise Price

Balance at February 3, 2002 13,765,674 $11.57

Granted (weighted average fair value of $15.71) 3,514,429 24.58

Exercised (2,019,273) 9.68

Canceled (693,724) 14.74

Balance at February 2, 2003 14,567,106 14.77

Granted (weighted average fair value of $15.56) 1,596,075 24.37

Exercised (3,294,478) 11.87

Canceled (1,089,045) 18.07

Balance at February 1, 2004 11,779,658 16.58

Granted (weighted average fair value of $20.58) 1,626,811 32.57

Exercised (1,817,308) 14.41

Canceled (488,734) 20.81

Balance at January 30, 2005 11,100,427 19.08

Exercisable, February 2, 2003 5,734,820 $10.60

Exercisable, February 1, 2004 5,077,371 12.83

Exercisable, January 30, 2005 5,461,541 14.26

Options to purchase 4,304,422 shares were available for grant at January 30, 2005.

53

Form 10-K