Pottery Barn 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

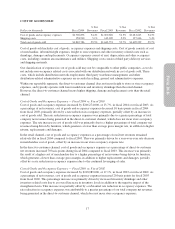

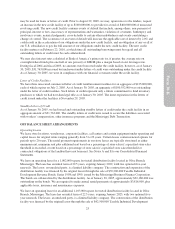

To increase our pre-tax operating margin, we expect to implement operational disciplines throughout the supply

chain to reduce returns, replacements and damages, particularly in furniture; improve our furniture sourcing and

inventory management disciplines by implementing a long-term capacity and production planning process with

key strategic vendors; and in-source the management of a primary furniture hub to develop a new “gold

standard” for customer service and to improve the overall operational efficiency of the furniture supply chain

process. Additionally, we plan to test on a national basis a new store replenishment program. During 2005, we

will begin replenishing our retail store inventories on a daily basis with UPS providing the transportation

services. The long-term benefits of this new replenishment program are to improve customer service by reducing

out of stocks in the stores, to reduce inventories in the back rooms of our stores and in local off-site storage

locations, and to reduce inventory damages and shrinkage due to less handling of the merchandise. In the short-

term, however, we expect to incur additional costs to implement this test, which we estimate at approximately

$0.01 per share in 2005.

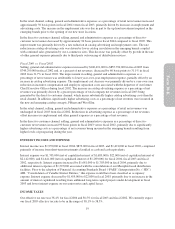

To enhance shareholder value, we remain committed to delivering against all three of our key strategies

including reaching three new financial milestones: surpassing $3.5 billion in revenues, achieving a 10.0% pre-tax

operating margin, and delivering the highest diluted earnings per share in the history of the Company.

13

Form 10-K