Pottery Barn 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

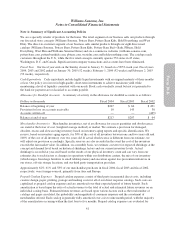

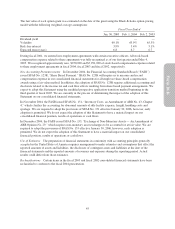

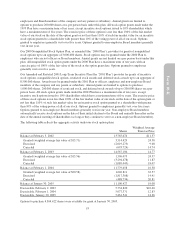

The fair value of each option grant was estimated on the date of the grant using the Black-Scholes option-pricing

model with the following weighted average assumptions:

Fiscal Year Ended

Jan. 30, 2005 Feb. 1, 2004 Feb. 2, 2003

Dividend yield — — —

Volatility 60.1% 63.9% 65.5%

Risk-free interest 3.9% 3.4% 5.1%

Expected term (years) 6.8 6.7 6.7

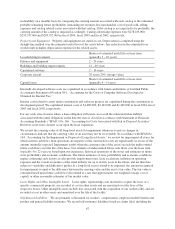

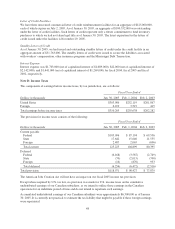

During fiscal 2001, we entered into employment agreements with certain executive officers. All stock-based

compensation expense related to these agreements was fully recognized as of our first quarter ended May 4,

2003. We recognized approximately zero, $250,000 and $7,291,000 of stock-based compensation expense related

to these employment agreements in fiscal 2004, fiscal 2003 and fiscal 2002, respectively.

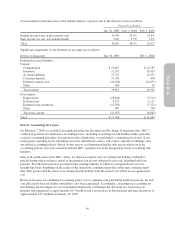

New Accounting Pronouncements In December 2004, the Financial Accounting Standards Board (“FASB”)

issued SFAS No. 123R, “Share Based Payment.” SFAS No. 123R will require us to measure and record

compensation expense in our consolidated financial statements for all employee share-based compensation

awards using a fair value method. In addition, the adoption of SFAS No. 123R requires additional accounting and

disclosure related to the income tax and cash flow effects resulting from share-based payment arrangements. We

expect to adopt this Statement using the modified prospective application transition method beginning in the

third quarter of fiscal 2005. We are currently in the process of determining the impact of the adoption of this

Statement on our consolidated financial statements.

In November 2004, the FASB issued SFAS No. 151, “Inventory Costs, an Amendment of ARB No. 43, Chapter

4,” which clarifies the accounting for abnormal amounts of idle facility expense, freight, handling costs and

spoilage. We are required to adopt the provisions of SFAS No. 151 effective January 30, 2006, however, early

adoption is permitted. We do not expect the adoption of this Statement to have a material impact on our

consolidated financial position, results of operations or cash flows.

In December 2004, the FASB issued SFAS No. 153, “Exchange of Non-Monetary Assets — An Amendment of

ARB Opinion No. 29,” which requires non-monetary asset exchanges to be accounted for at fair value. We are

required to adopt the provisions of SFAS No. 153 effective January 30, 2006, however, early adoption is

permitted. We do not expect the adoption of this Statement to have a material impact on our consolidated

financial position, results of operations or cash flows.

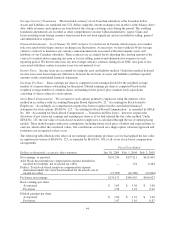

Use of Estimates The preparation of financial statements in conformity with accounting principles generally

accepted in the United States of America requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the

financial statements and the reported amounts of revenues and expenses during the reporting period. Actual

results could differ from those estimates.

Reclassifications Certain items in the fiscal 2003 and fiscal 2002 consolidated financial statements have been

reclassified to conform to the fiscal 2004 presentation.

45

Form 10-K