Pottery Barn 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

OVERVIEW

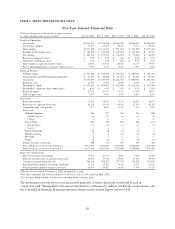

In fiscal 2004, our diluted earnings per share increased by 21.2% to $1.60 and our net revenues increased 13.9%

to $3.137 billion from $2.754 billion in fiscal 2003. The net revenues increase was primarily driven by increases

in the Pottery Barn, Pottery Barn Kids, PBteen and Williams-Sonoma concepts. Increasing our revenues was a

key strategic initiative for us in 2004 and we are pleased to have been able to deliver these results, despite a

significantly weaker than expected consumer response to the holiday merchandising strategies in the Pottery

Barn brand in the fourth quarter.

In our retail channel, net revenues increased 11.6% during fiscal 2004 versus fiscal 2003. This increase was

primarily driven by a year-over-year increase in retail leased square footage of 11.4%, including 40 net new

stores, and a comparable store sales increase of 3.5%. Net sales generated in the Pottery Barn, Williams-Sonoma,

and Pottery Barn Kids brands were the primary contributors to the year-over-year sales increase, partially offset

by the transitional impact of our Hold Everything brand realignment strategy. We achieved positive comparable

store sales growth in each of our core brands in fiscal 2004.

In our direct-to-customer channel, net revenues increased 17.1% during fiscal 2004 versus fiscal 2003. This year-

over-year increase was primarily driven by net sales generated in the Pottery Barn, PBteen, Pottery Barn Kids

and West Elm brands resulting from increased catalog and page count circulation and the continued success of

our e-commerce initiatives, as well as incremental net sales generated by the November launch of the Hold

Everything e-commerce website. All of the brands in the direct-to-customer channel delivered positive growth

during the fiscal year with the exception of the Chambers brand, which was retired in the second quarter of 2004

in anticipation of the launch of the Williams-Sonoma Home brand in the third quarter of 2004.

In our core brands, net sales increased 12.2% in 2004, primarily driven by net sales increases in both the Pottery

Barn and Pottery Barn Kids brands and a mid-single digit net sales increase in the Williams-Sonoma brand.

In our emerging brands, including PBteen, West Elm, Hold Everything, and Williams-Sonoma Home, net sales

increased 38.0%, primarily driven by strong performance in the PBteen and West Elm brands.

Net sales in 2004 in the PBteen brand increased 97.8% primarily driven by incremental sales from the

e-commerce website that was launched in October 2003 and a 55% increase in catalog circulation. Although we

continue to believe that it is too early to predict the ultimate growth potential of PBteen, the strong consumer

response to this brand leads us to believe that we have identified another underserved market segment in the

home, similar to Pottery Barn Kids, that could provide a significant long-term growth opportunity for the future.

Net sales in the West Elm brand increased 75.9% primarily driven by significant growth in the e-commerce

channel and an extremely successful retail launch. In late 2004, we opened three new prototype stores in the

West Elm brand, all of which currently rank in the top volume producing stores in the Company.

Net sales in 2004 in the Hold Everything brand increased 2.5%. Within the brand, 2004 was a year of significant

transition in both the merchandising strategy and the lifestyle positioning of the brand. During 2004, we added

significant management resources and infrastructure to support the future growth of the brand. In the direct-to-

customer channel, we increased catalog prospecting to revitalize the customer database and launched the first

Hold Everything e-commerce website in November. We also opened three new prototype stores in November.

Although the overall growth in the Hold Everything brand met our expectations in 2004, its growth potential was

limited by the breadth of the current merchandise assortment. We are currently in the process of developing

substantially expanded assortments for 2005 and 2006.

Our newest brand, Williams-Sonoma Home, was launched in the third quarter of 2004. On a circulation of over

10 million catalogs, net sales in the brand were in line with the low end of our expectations. What we found

especially encouraging about the initial consumer response to the overall merchandise assortment was the

stronger than expected demand for custom upholstered furniture, which we believe speaks to the long-term

competitive advantage that we can create in this brand by leveraging the strength of our supply chain organization.

11

Form 10-K