Pottery Barn 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating Leases

We lease store locations, warehouses, corporate facilities, call centers and certain equipment under operating and

capital leases for original terms ranging generally from 3 to 22 years. Certain leases contain renewal options for

periods up to 20 years. The rental payment requirements in our store leases are typically structured as either

minimum rent, minimum rent plus additional rent based on a percentage of store sales if a specified store sales

threshold is exceeded, or rent based on a percentage of store sales if a specified store sales threshold or

contractual obligations of the landlord have not been met.

We have an operating lease for a 1,002,000 square foot retail distribution facility located in Olive Branch,

Mississippi. The lease has an initial term of 22.5 years, expiring January 2022, with two optional five-year

renewals. The lessor, an unrelated party, is a limited liability company. The construction and expansion of the

distribution facility was financed by the original lessor through the sale of $39,200,000 Taxable Industrial

Development Revenue Bonds, Series 1998 and 1999, issued by the Mississippi Business Finance Corporation.

The bonds are collateralized by the distribution facility. As of January 30, 2005, approximately $32,180,000 was

outstanding on the bonds. We are required to make annual rental payments of approximately $3,816,000, plus

applicable taxes, insurance and maintenance expenses.

We have an operating lease for an additional 1,103,000 square foot retail distribution facility located in Olive

Branch, Mississippi. The lease has an initial term of 22.5 years, expiring January 2023, with two optional five-

year renewals. The lessor, an unrelated party, is a limited liability company. The construction of the distribution

facility was financed by the original lessor through the sale of $42,500,000 Taxable Industrial Development

Revenue Bonds, Series 1999, issued by the Mississippi Business Finance Corporation. The bonds are

collateralized by the distribution facility. As of January 30, 2005, approximately $35,235,000 was outstanding on

the bonds. We are required to make annual rental payments of approximately $4,181,000, plus applicable taxes,

insurance and maintenance expenses.

In December 2003, we entered into an agreement to lease an additional 780,000 square foot distribution facility

located in Olive Branch, Mississippi. The lease has an initial term of six years, with two optional two-year

renewals. The agreement includes an option to lease an additional 333,000 square feet of the same distribution

center. As of January 30, 2005, we had not exercised this option, however, we expect to exercise this option

during fiscal 2005. We are required to make annual rental payments of approximately $1,927,000, plus

applicable taxes, insurance and maintenance expenses.

On February 2, 2004, we entered into an agreement to lease 781,000 square feet of a distribution center located in

Cranbury, New Jersey. The lease has an initial term of seven years, with three optional five-year renewals. The

agreement requires us to lease an additional 219,000 square feet of the facility in the event the current tenant

vacates the premises. We are required to make annual rental payments of approximately $3,397,000, plus

applicable taxes, insurance and maintenance expenses.

On August 18, 2004, we entered into an agreement to lease a 500,000 square foot distribution facility located in

Memphis, Tennessee. The lease has an initial term of four years, with one optional three-year and nine-month

renewal. We are required to make annual rental payments of approximately $1,025,000, plus applicable taxes,

insurance and maintenance expenses.

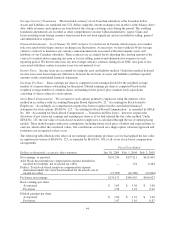

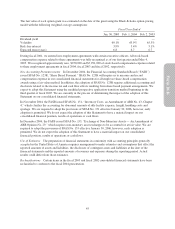

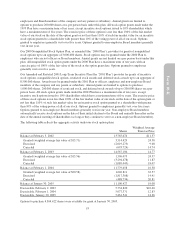

Total rental expense for all operating leases was as follows:

Fiscal Year Ended

Dollars in thousands Jan. 30, 2005 Feb. 1, 20041Feb. 2, 20031

Minimum rent expense $110,618 $101,377 $ 95,173

Contingent rent expense 26,724 21,796 19,626

Less: Sublease rental income (59) (90) (503)

Total rent expense $137,283 $123,083 $114,296

1Includes rent expense for our Memphis-based distribution facilities which were consolidated by us on February 1, 2004. See

Note F.

50