Pottery Barn 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

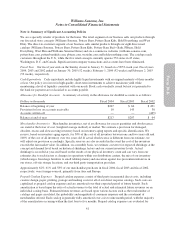

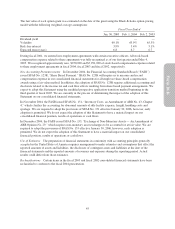

Letter of Credit Facilities

We have three unsecured commercial letter of credit reimbursement facilities for an aggregate of $125,000,000,

each of which expires on July 2, 2005. As of January 30, 2005, an aggregate of $100,552,000 was outstanding

under the letter of credit facilities. Such letters of credit represent only a future commitment to fund inventory

purchases to which we had not taken legal title as of January 30, 2005. The latest expiration for the letters of

credit issued under the facilities is November 29, 2005.

Standby Letters of Credit

As of January 30, 2005, we had issued and outstanding standby letters of credit under the credit facility in an

aggregate amount of $31,763,000. The standby letters of credit were issued to secure the liabilities associated

with workers’ compensation, other insurance programs and the Mississippi Debt Transaction.

Interest Expense

Interest expense was $1,703,000 (net of capitalized interest of $1,689,000), $22,000 (net of capitalized interest of

$2,142,000), and $1,441,000 (net of capitalized interest of $1,269,000) for fiscal 2004, fiscal 2003 and fiscal

2002, respectively.

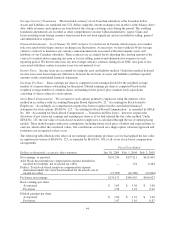

Note D: Income Taxes

The components of earnings before income taxes, by tax jurisdiction, are as follows:

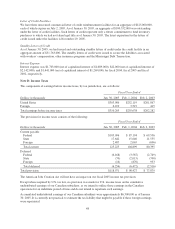

Fiscal Year Ended

Dollars in thousands Jan. 30, 2005 Feb. 1, 2004 Feb. 2, 2003

United States $303,986 $252,119 $201,867

Foreign 6,219 3,519 415

Total earnings before income taxes $310,205 $255,638 $202,282

The provision for income taxes consists of the following:

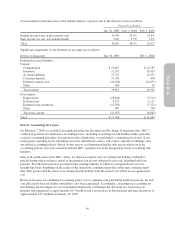

Fiscal Year Ended

Dollars in thousands Jan. 30, 2005 Feb. 1, 2004 Feb. 2, 2003

Current payable

Federal $105,096 $ 87,194 $ 69,536

State 17,642 15,640 11,555

Foreign 2,487 2,065 (696)

Total current 125,225 104,899 80,395

Deferred

Federal (6,168) (3,587) (2,749)

State (70) (2,015) (700)

Foreign (16) (870) 933

Total deferred (6,254) (6,472) (2,516)

Total provision $118,971 $ 98,427 $ 77,879

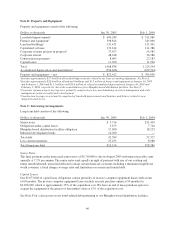

The American Jobs Creation Act will not have an impact on our fiscal 2005 income tax provision.

Except where required by U.S. tax law, no provision was made for U.S. income taxes on the cumulative

undistributed earnings of our Canadian subsidiary, as we intend to utilize those earnings in the Canadian

operations for an indefinite period of time and do not intend to repatriate such earnings.

Accumulated undistributed earnings of our Canadian subsidiary were approximately $6,300,000 as of January

30, 2005. It is currently not practical to estimate the tax liability that might be payable if these foreign earnings

were repatriated.

48