Pottery Barn 2004 Annual Report Download - page 31

Download and view the complete annual report

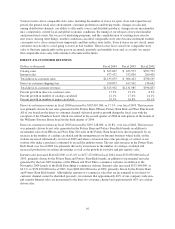

Please find page 31 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Revenue Bonds, Series 1999, issued by the Mississippi Business Finance Corporation. The bonds are

collateralized by the distribution facility. As of January 30, 2005, approximately $35,235,000 was outstanding on

the bonds. We are required to make annual rental payments of approximately $4,181,000, plus applicable taxes,

insurance and maintenance expenses.

In December 2003, we entered into an agreement to lease an additional 780,000 square foot distribution facility

located in Olive Branch, Mississippi. The lease has an initial term of six years, with two optional two-year

renewals. The agreement includes an option to lease an additional 333,000 square feet of the same distribution

center. As of January 30, 2005, we had not exercised this option, however, we expect to exercise this option

during fiscal 2005. We are required to make annual rental payments of approximately $1,927,000, plus

applicable taxes, insurance and maintenance expenses.

On February 2, 2004, we entered into an agreement to lease 781,000 square feet of a distribution center located in

Cranbury, New Jersey. The lease has an initial term of seven years, with three optional five-year renewals. The

agreement requires us to lease an additional 219,000 square feet of the facility in the event the current tenant

vacates the premises. We are required to make annual rental payments of approximately $3,397,000, plus

applicable taxes, insurance and maintenance expenses.

On August 18, 2004, we entered into an agreement to lease a 500,000 square foot distribution facility located in

Memphis, Tennessee. The lease has an initial term of four years, with one optional three-year and nine-month

renewal. We are required to make annual rental payments of approximately $1,025,000, plus applicable taxes,

insurance and maintenance expenses.

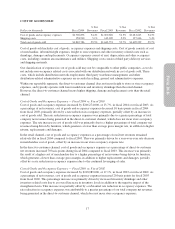

In November 2002, the FASB issued FIN 45, “Guarantor’s Accounting and Disclosure Requirements for

Guarantees, Including Indirect Guarantees of Indebtedness of Others,” which requires certain guarantees to be

recorded at fair value. In general, the interpretation applies to contracts or indemnification agreements that

contingently require the guarantor to make payments to the guaranteed party based on changes in an underlying

obligation that is related to an asset, liability, or an equity security of the guaranteed party. We leased an aircraft

over a term of 60 months, which ended in January 2005. At the end of the lease term, the lease allowed us to

either purchase the aircraft for $11,500,000 or sell it. If the proceeds were less than $11,500,000, we were

required to pay the lessor the difference up to $9,080,000. In January 2005, we purchased the aircraft for

$11,500,000 and the lessor released our guarantee requirements.

In addition, we are party to a variety of contractual agreements under which we may be obligated to indemnify

the other party for certain matters. These contracts primarily relate to our commercial contracts, operating leases,

trademarks, intellectual property, financial agreements and various other agreements. Under these contracts, we

may provide certain routine indemnifications relating to representations and warranties or personal injury

matters. The terms of these indemnifications range in duration and may not be explicitly defined. Historically, we

have not made significant payments for these indemnifications. We believe that if we were to incur a loss in any

of these matters, the loss would not have a material effect on our financial condition or results of operations.

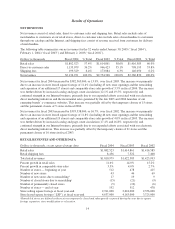

CONSOLIDATION OF MEMPHIS-BASED DISTRIBUTION FACILITIES

Our Memphis-based distribution facilities include an operating lease entered into in July 1983 for a distribution

facility in Memphis, Tennessee. The lessor is a general partnership (“Partnership 1”) comprised of W. Howard

Lester, Chairman of the Board of Directors and a significant shareholder, and James A. McMahan, a Director

Emeritus and a significant shareholder. Partnership 1 does not have operations separate from the leasing of this

distribution facility and does not have lease agreements with any unrelated third parties.

Partnership 1 financed the construction of this distribution facility through the sale of a total of $9,200,000 of

industrial development bonds in 1983 and 1985. Annual principal payments and monthly interest payments are

required through maturity in December 2010. The Partnership 1 industrial development bonds are collateralized

by the distribution facility and the individual partners guarantee the bond repayments. As of January 30, 2005,

$2,341,000 was outstanding under the Partnership 1 industrial development bonds.

24