Pottery Barn 2004 Annual Report Download - page 19

Download and view the complete annual report

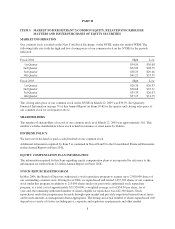

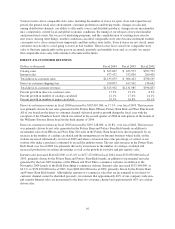

Please find page 19 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During fiscal 2004, we also continued to improve our pre-tax operating margin, increasing from 9.3% in 2003 to

9.9% in 2004. This increase in the pre-tax operating margin was the result of several successful operational

initiatives, including:

• A reduction in shipping costs as a percentage of net revenues driven by the ongoing consolidation of

freight providers, the in-sourcing of line-haul management in the furniture delivery network, and the

strategic positioning of our coastal distribution centers in the proximity of our customer-base;

• A reduction in telecommunication expenses driven by the renegotiation of our company-wide vendor

agreements; and

• A reduction in corporate overhead expenses as a percentage of net revenues due to strong expense

management initiatives, primarily in employment and employment-related expenses.

During 2004, we made progress in building our infrastructure to support the growth of our core and emerging

brands. In the information technology area, we entered into two strategic vendor partnerships with IBM: one to

host and manage our data center and one to host our e-commerce websites. These agreements were entered into

in order to more cost-effectively manage our information technology infrastructure, while at the same time,

enhancing the functionality of our e-commerce websites. We also continued to invest in our new direct-to-

customer order management and inventory management systems, which are currently in beta testing in our Hold

Everything brand. These multi-phase, multi-year technology initiatives are at the heart of our long-term efforts to

drive increased sales and reduced costs through productivity and operational efficiency.

In the area of inventory management and distribution operations, we increased our distribution center leased

square footage, in part by opening our first east coast distribution center in Cranbury, New Jersey. We also made

progress on our “weeks of supply” inventory management initiative, which resulted in a reduction in the base

levels of our inventory due to more efficiently flowing merchandise through the supply chain. The sustainable

benefit of this initiative, however, will not be realized until we implement our new merchandising systems in

2006.

As we enter 2005, we will continue to focus on our three long-term strategic initiatives: driving profitable top-

line sales growth; increasing pre-tax operating margin; and enhancing shareholder value.

To drive profitable top-line sales growth, we expect to add 26 net new retail locations, increase catalog

circulation, expand customer contacts through electronic direct marketing, and intensify the marketing support

behind our bridal and gift registry businesses. In our emerging brands, we plan to focus on executing initiatives

that we believe will build brand awareness and enhance customer access to the brands. In PBteen in 2005, we

plan to increase catalog circulation and expand our successful on-line marketing initiatives. We also plan to drive

aggressive name capture programs to expand our teen affinity database. In West Elm, we plan to increase catalog

circulation and open seven new retail stores. We continue to believe that West Elm has the potential to be our

largest brand, if we can successfully evolve the merchandising strategy, broaden the overall consumer appeal,

and capture the mind share of the large consumer segment that West Elm targets. In Williams-Sonoma Home in

2005, we plan to increase catalog circulation, add catalog ordering functionality to the current e-catalog website,

and open three new prototype stores in the third quarter. We believe that the retail launch in Williams-Sonoma

Home is strategic to expanding the multi-channel reach of the brand due to the customer’s desire to interact with

the product and fully experience the design authority of the brand. In Hold Everything, we plan to significantly

refine our catalog circulation strategy, expand our on-line marketing initiatives, and open two additional

prototype stores. We also plan to introduce new merchandise assortments throughout the year that will reflect the

lifestyle transition of the brand, including a significantly enhanced assortment in furniture, casual upholstery,

textiles, lighting, and tabletop.

12