Pottery Barn 2004 Annual Report Download - page 39

Download and view the complete annual report

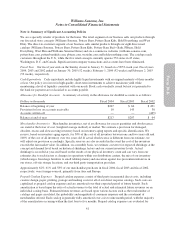

Please find page 39 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our failure to successfully manage the costs and performance of our catalog mailings might have a negative

impact on our business.

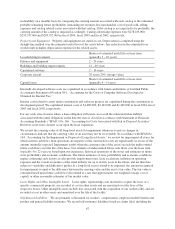

Postal rate increases, paper costs, printing costs and other catalog distribution costs affect the cost of our catalog

mailings. We rely on discounts from the basic postal rate structure, such as discounts for bulk mailings and

sorting by zip code and carrier routes. Our cost of paper has fluctuated significantly during the past three fiscal

years, and our paper costs are expected to increase in the future. Although we have entered into a long-term

contract for catalog printing, this contract offers no assurance that our catalog production costs will not

substantially increase following its expiration. Future increases in postal rates or paper or printing costs would

have a negative impact on our operating results to the extent that we are unable to pass such increases on directly

to customers or offset such increases by raising prices or by implementing more efficient printing, mailing,

delivery and order fulfillment systems.

We have historically experienced fluctuations in customer response to our catalogs. Customer response to our

catalogs is substantially dependent on merchandise assortment, merchandise availability and creative

presentation, as well as the sizing and timing of delivery of the catalogs. In addition, environmental organizations

may attempt to create an unfavorable impression of our paper use in catalogs. The failure to effectively produce

or distribute our catalogs could affect the timing of catalog delivery, which could cause customers to forego or

defer purchases.

We must successfully manage our Internet business.

The success of our Internet business depends, in part, on factors over which we have limited control. In addition

to changing consumer preferences and buying trends relating to Internet usage, we are vulnerable to certain

additional risks and uncertainties associated with the Internet, including changes in required technology

interfaces, website downtime and other technical failures, changes in applicable federal and state regulation,

security breaches, and consumer privacy concerns. Our failure to successfully respond to these risks and

uncertainties might adversely affect the sales in our Internet business, as well as damage our reputation and

brands.

Our failure to successfully anticipate merchandise returns might have a negative impact on our business.

We record a reserve for merchandise returns based on historical return trends together with current product sales

performance in each reporting period. If actual returns are greater than those projected by management,

additional sales returns might be recorded in the future. Actual merchandise returns may exceed our reserves. In

addition, to the extent that returned merchandise is damaged, we may not receive full retail value from the resale

or liquidation of the merchandise. Further, the introduction of new merchandise, changes in merchandise mix,

changes in consumer confidence, or other competitive and general economic conditions may cause actual returns

to exceed merchandise return reserves. Any significant increase in merchandise returns that exceeds our reserves

could negatively impact our business and operating results.

We must successfully manage the complexities associated with a multi-channel and multi-brand business.

During the past few years, with the launch and expansion of our Internet business, new brands and brand

expansions, our overall business has become substantially more complex. The changes in our business have

forced us to develop new expertise and face new challenges, risks and uncertainties. For example, we face the

risk that our Internet business might cannibalize a significant portion of our retail and catalog businesses. While

we recognize that our Internet sales cannot be entirely incremental to sales through our retail and catalog

channels, we seek to attract as many new customers as possible to our e-commerce websites. We continually

analyze the business results of our three channels and the relationships among the channels, in an effort to find

opportunities to build incremental sales. However, as our Internet business grows and as we add e-commerce

websites for more of our concepts, these increased Internet sales may cannibalize a portion of our retail and

catalog businesses.

32