Pottery Barn 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

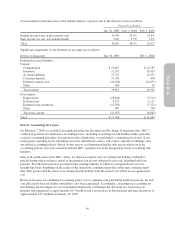

Industrial Development Bonds

In June 2004, in an effort to utilize tax incentives offered to us by the state of Mississippi, we entered into an

agreement whereby the Mississippi Business Finance Corporation issued $15,000,000 in long-term variable rate

industrial development bonds, the proceeds, net of debt issuance costs, of which were loaned to us to finance the

acquisition and installation of leasehold improvements and equipment located in our newly leased Olive Branch

distribution center (the “Mississippi Debt Transaction”). The bonds are marketed through a remarketing agent

and are secured by a letter of credit issued under our $200,000,000 line of credit facility. The bonds mature on

June 1, 2024. The bond rate resets each week based upon current market rates. The rate in effect at January 30,

2005 was 2.6%.

The bond agreement allows for each bondholder to tender their bonds to the trustee for repurchase, on demand,

with seven days advance notice. In the event the remarketing agent fails to remarket the bonds, the trustee will

draw upon the letter of credit to fund the purchase of the bonds. As of January 30, 2005, these bonds were

classified as current debt. The bond proceeds are restricted for use in the acquisition and installation of leasehold

improvements and equipment located in our Olive Branch, Mississippi facility. As of January 30, 2005, we had

acquired and installed $9,546,000 of leasehold improvements and equipment associated with the facility.

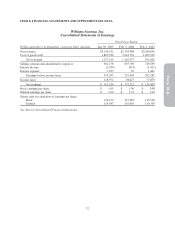

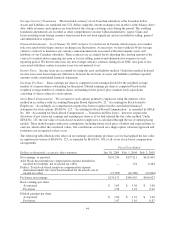

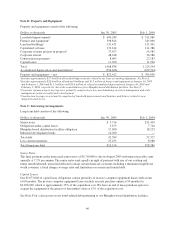

The aggregate maturities of long-term debt at January 30, 2005 were as follows:

Dollars in thousands

Fiscal 20051$23,435

Fiscal 2006 4,679

Fiscal 2007 1,653

Fiscal 2008 1,584

Fiscal 2009

Thereafter

1,438

9,800

Total $42,589

1Includes $14.2 million related to the Mississippi Debt Transaction classified as current debt.

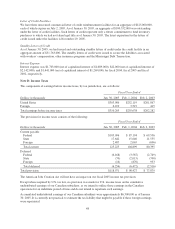

Credit Facility

As of January 30, 2005, we had a credit facility that provided for $200,000,000 of unsecured revolving credit and

contained certain financial covenants, including a minimum tangible net worth covenant, a maximum leverage

ratio (funded debt adjusted for lease and rent expense to EBITDAR), a minimum fixed charge coverage ratio and

a maximum annual capital expenditures covenant. The credit facility was due to expire on October 22, 2005. On

February 22, 2005, we entered into the Third Amended and Restated Credit Agreement that amends and replaces

our credit facility. The new credit facility provides for a $300,000,000 unsecured revolving line of credit that

may be used for loans or letters of credit. Prior to August 22, 2009, we may, upon notice to the lenders, request

an increase in the new credit facility of up to $100,000,000, to provide for a total of $400,000,000 of unsecured

revolving credit. The new credit facility contains events of default that include, among others, non-payment of

principal, interest or fees, inaccuracy of representations and warranties, violation of covenants, bankruptcy and

insolvency events, material judgments, cross defaults to certain other indebtedness and events constituting a

change of control. The occurrence of an event of default will increase the applicable rate of interest by 2.0% and

could result in the acceleration of our obligations under the new credit facility, and an obligation of any or all of

our U.S. subsidiaries to pay the full amount of our obligations under the new credit facility. The new credit

facility matures on February 22, 2010, at which time all outstanding borrowings must be repaid and all

outstanding letters of credit must be cash collateralized.

We may elect interest rates calculated at Bank of America’s prime rate (or, if greater, the average rate on

overnight federal funds plus one-half of one percent) or LIBOR plus a margin based on our leverage ratio.

During fiscal 2004 and fiscal 2003, no amounts were borrowed under the credit facility, however, as of January

30, 2005, $31,763,000 in issued but undrawn standby letters of credit were outstanding under the credit facility.

As of January 30, 2005, we were in compliance with our financial covenants under the credit facility.

47

Form 10-K