Pottery Barn 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

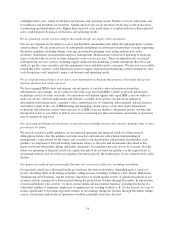

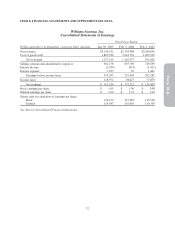

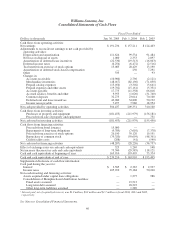

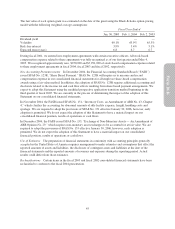

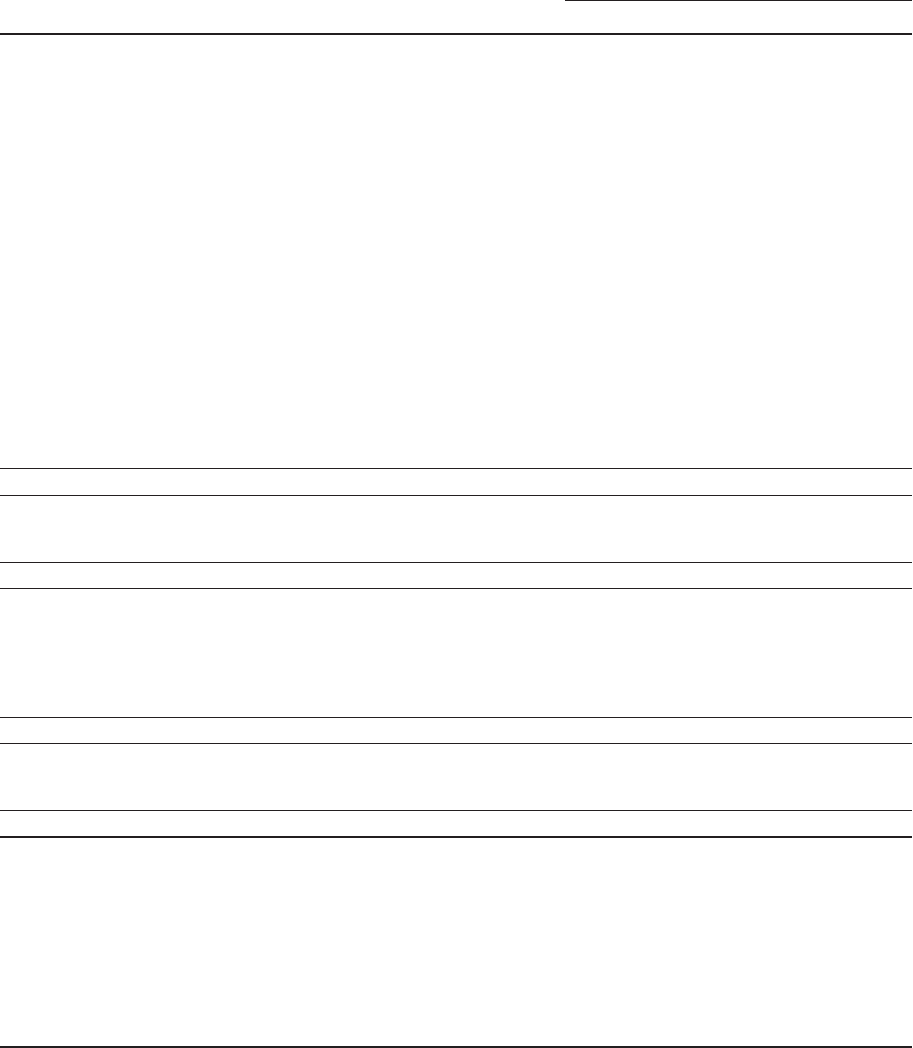

Williams-Sonoma, Inc.

Consolidated Statements of Cash Flows

Fiscal Year Ended

Dollars in thousands Jan. 30, 2005 Feb. 1, 2004 Feb. 2, 2003

Cash flows from operating activities:

Net earnings $ 191,234 $ 157,211 $ 124,403

Adjustments to reconcile net earnings to net cash provided by

operating activities:

Depreciation and amortization 111,624 99,534 91,484

Net loss on disposal of assets 1,080 2,353 2,897

Amortization of deferred lease incentives (22,530) (19,513) (16,063)

Deferred income taxes (6,254) (6,472) (2,516)

Tax benefit from exercise of stock options 13,085 20,429 13,190

Amortization of deferred stock-based compensation — 250 7,291

Other 335 — 93

Changes in:

Accounts receivable (10,900) 2,796 (2,121)

Merchandise inventories (48,017) (82,196) (71,850)

Prepaid catalog expenses (15,056) (3,302) (5,641)

Prepaid expenses and other assets (19,702) (15,161) (5,331)

Accounts payable 17,773 (11,358) 66,818

Accrued salaries, benefits and other 9,955 (1,020) (31,740)

Customer deposits 32,273 23,014 70,100

Deferred rent and lease incentives 42,080 34,800 50,192

Income taxes payable 7,457 7,986 18,954

Net cash provided by operating activities 304,437 209,351 310,160

Cash flows from investing activities:

Purchases of property and equipment (181,453) (211,979) (156,181)

Proceeds from sale of property and equipment — — 731

Net cash used in investing activities (181,453) (211,979) (155,450)

Cash flows from financing activities:

Proceeds from bond issuance 15,000 — —

Repayments of long-term obligations (9,789) (7,610) (7,378)

Proceeds from exercise of stock options 26,190 39,120 19,551

Repurchase of common stock (79,320) (59,695) (48,361)

Credit facility costs (288) (41) (549)

Net cash used in financing activities (48,207) (28,226) (36,737)

Effect of exchange rates on cash and cash equivalents 523 1,269 148

Net increase (decrease) in cash and cash equivalents 75,300 (29,585) 118,121

Cash and cash equivalents at beginning of year 163,910 193,495 75,374

Cash and cash equivalents at end of year $ 239,210 $ 163,910 $ 193,495

Supplemental disclosure of cash flow information:

Cash paid during the year for:

Interest1$ 3,585 $ 2,367 $ 2,937

Income taxes 105,910 79,184 50,240

Non cash investing and financing activities:

Assets acquired under capital lease obligations — 1,275 986

Consolidation of Memphis-based distribution facilities:

Fixed assets assumed

Long-term debt assumed

Other long-term liabilities assumed

—

—

—

19,512

18,223

1,289

—

—

—

1Interest paid, net of capitalized interest, was $1.9 million, $0.2 million and $1.7 million in fiscal 2004, 2003 and 2002,

respectively.

See Notes to Consolidated Financial Statements.

40