Pottery Barn 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Williams-Sonoma, Inc.

Notes to Consolidated Financial Statements

Note A: Summary of Significant Accounting Policies

We are a specialty retailer of products for the home. The retail segment of our business sells our products through

our five retail store concepts (Williams-Sonoma, Pottery Barn, Pottery Barn Kids, Hold Everything, and West

Elm). The direct-to-customer segment of our business sells similar products through our eight direct-mail

catalogs (Williams-Sonoma, Pottery Barn, Pottery Barn Kids, Pottery Barn Bed + Bath, PBteen, Hold

Everything, West Elm and Williams-Sonoma Home) and six e-commerce websites (williams-sonoma.com,

potterybarn.com, potterybarnkids.com, pbteen.com, westelm.com and holdeverything.com). The catalogs reach

customers throughout the U.S., while the five retail concepts currently operate 552 stores in 43 states,

Washington, D.C. and Canada. Significant intercompany transactions and accounts have been eliminated.

Fiscal Year Our fiscal year ends on the Sunday closest to January 31, based on a 52/53-week year. Fiscal years

2004, 2003 and 2002 ended on January 30, 2005 (52 weeks), February 1, 2004 (52 weeks) and February 2, 2003

(52 weeks), respectively.

Cash Equivalents Cash equivalents include highly liquid investments with an original maturity of three months

or less. Our policy is to invest in high-quality, short-term instruments to achieve maximum yield while

maintaining a level of liquidity consistent with our needs. Book cash overdrafts issued but not yet presented to

the bank for payment are reclassified to accounts payable.

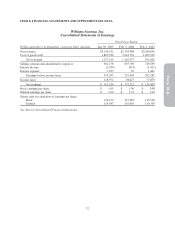

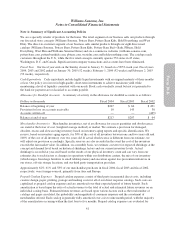

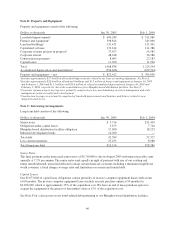

Allowance for Doubtful Accounts A summary of activity in the allowance for doubtful accounts is as follows:

Dollars in thousands Fiscal 2004 Fiscal 2003 Fiscal 2002

Balance at beginning of year $207 $ 64 $ 491

Provision for loss on accounts receivable 10 143 38

Accounts written off — — (465)

Balance at end of year $217 $207 $ 64

Merchandise Inventories Merchandise inventories, net of an allowance for excess quantities and obsolescence,

are stated at the lower of cost (weighted average method) or market. We estimate a provision for damaged,

obsolete, excess and slow-moving inventory based on inventory aging reports and specific identification. We

reserve, based on inventory aging reports, for 50% of the cost of all inventory between one and two years old and

100% of the cost of all inventory over two years old. If actual obsolescence is different from our estimate, we

will adjust our provision accordingly. Specific reserves are also recorded in the event the cost of the inventory

exceeds the fair market value. In addition, on a monthly basis, we estimate a reserve for expected shrinkage at the

concept and channel level based on historical shrinkage factors and our current inventory levels. Actual

shrinkage is recorded at year-end based on the results of our physical inventory count and can vary from our

estimates due to such factors as changes in operations within our distribution centers, the mix of our inventory

(which ranges from large furniture to small tabletop items) and execution against loss prevention initiatives in

our stores, off-site storage locations, and our third party transportation providers.

Approximately 62%, 61% and 58% of our merchandise purchases in fiscal 2004, fiscal 2003 and fiscal 2002,

respectively, were foreign-sourced, primarily from Asia and Europe.

Prepaid Catalog Expenses Prepaid catalog expenses consist of third party incremental direct costs, including

creative design, paper, printing, postage and mailing costs for all of our direct response catalogs. Such costs are

capitalized as prepaid catalog expenses and are amortized over their expected period of future benefit. Such

amortization is based upon the ratio of actual revenues to the total of actual and estimated future revenues on an

individual catalog basis. Estimated future revenues are based upon various factors such as the total number of

catalogs and pages circulated, the probability and magnitude of consumer response and the assortment of

merchandise offered. Each catalog is generally fully amortized over a six to nine month period, with the majority

of the amortization occurring within the first four to five months. Prepaid catalog expenses are evaluated for

41

Form 10-K