Pottery Barn 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Industrial Development Bonds

In June 2004, in an effort to utilize tax incentives offered to us by the state of Mississippi, we entered into an

agreement whereby the Mississippi Business Finance Corporation issued $15,000,000 in long-term variable rate

industrial development bonds, the proceeds, net of debt issuance costs, of which were loaned to us to finance the

acquisition and installation of leasehold improvements and equipment located in our newly leased Olive Branch

distribution center (the “Mississippi Debt Transaction”). The bonds are marketed through a remarketing agent

and are secured by a letter of credit issued under our $200,000,000 line of credit facility. The bonds mature on

June 1, 2024. The bond rate resets each week based upon current market rates. The rate in effect at January 30,

2005 was 2.6%.

The bond agreement allows for each bondholder to tender their bonds to the trustee for repurchase, on demand,

with seven days advance notice. In the event the remarketing agent fails to remarket the bonds, the trustee will

draw upon the letter of credit to fund the purchase of the bonds. As of January 30, 2005, these bonds were

classified as current debt. The bond proceeds are restricted for use in the acquisition and installation of leasehold

improvements and equipment located in our Olive Branch, Mississippi facility. As of January 30, 2005, we had

acquired and installed $9,546,000 of leasehold improvements and equipment associated with the facility.

Capital Leases

Our $5,673,000 of capital lease obligations consist primarily of in-store computer equipment leases with a term

of 60 months. The in-store computer equipment leases include an early purchase option at 54 months for

$2,496,000, which is approximately 25% of the acquisition cost. We have an end of lease purchase option to

acquire the equipment at the greater of fair market value or 15% of the acquisition cost.

Other Contractual Obligations

We have other long-term liabilities reflected in our consolidated balance sheets, including deferred income taxes

and insurance accruals. The payment obligations associated with these liabilities are not reflected in the table

above due to the absence of scheduled maturities. The timing of these payments cannot be determined, except for

amounts estimated to be payable in fiscal 2005 which are included in our current liabilities as of January 30,

2005.

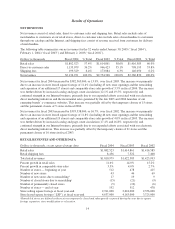

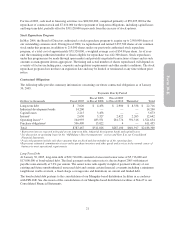

Commercial Commitments

The following table provides summary information concerning our outstanding commercial commitments as of

January 30, 2005.

Amount of Outstanding Commitment Expiration By Period

Dollars in thousands Fiscal 2005

Fiscal 2006

to Fiscal 2008

Fiscal 2009

to Fiscal 2010 Thereafter Total

Credit facility — — — — —

Letter of credit facilities $100,552 — — — $100,552

Standby letters of credit 31,763 — — — 31,763

Total $132,315 — — — $132,315

Credit Facility

As of January 30, 2005, we had a credit facility that provided for $200,000,000 of unsecured revolving credit and

contained certain financial covenants, including a minimum tangible net worth covenant, a maximum leverage

ratio (funded debt adjusted for lease and rent expense to EBITDAR), a minimum fixed charge coverage ratio and

a maximum annual capital expenditures covenant. The credit facility was due to expire on October 22, 2005. On

February 22, 2005, we entered into the Third Amended and Restated Credit Agreement that amends and replaces

our credit facility. The new credit facility provides for a $300,000,000 unsecured revolving line of credit that

22