Pottery Barn 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

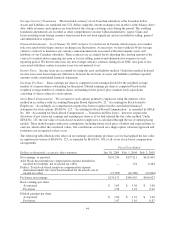

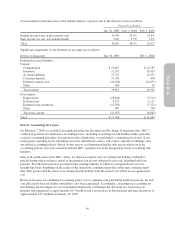

The following table summarizes information about stock options outstanding at January 30, 2005:

Options Outstanding Options Exercisable

Range of exercise prices

Number

Outstanding

Weighted

Average

Contractual

Life (Years)

Weighted

Average

Exercise

Price

Number

Exercisable

Weighted

Average

Exercise

Price

$ 4.50 – $ 9.50 2,243,361 3.71 $ 8.10 1,864,521 $ 7.83

$ 9.66 – $14.50 2,431,715 5.20 12.91 1,600,773 12.56

$14.84 – $22.47 2,643,471 6.71 19.72 1,242,430 17.99

$22.48 – $31.58 2,222,380 8.00 26.51 621,817 26.51

$32.01 – $40.05 1,559,500 9.13 32.84 132,000 32.85

$ 4.50 – $40.05 11,100,427 6.37 $19.08 5,461,541 $14.26

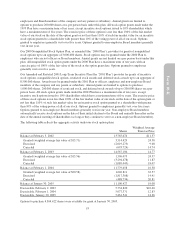

Note J: Associate Stock Incentive Plan and Other Employee Benefits

We have a defined contribution retirement plan, the “Williams-Sonoma, Inc. Associate Stock Incentive Plan”

(the “Plan”), for eligible employees, which is intended to be qualified under Internal Revenue Code Sections

401(a), 401(k) and 401(m). The Plan permits eligible employees to make salary deferral contributions in

accordance with Internal Revenue Code Section 401(k) up to 15% of eligible compensation each pay period (4%

in the case of certain higher paid individuals). Employees designate the funds in which their contributions are

invested. Each participant may choose to have his or her salary deferral contributions and earnings thereon

invested in one or more investment funds, including investing in our company stock fund. All amounts

contributed by the company are invested in our common stock fund. Through August 1, 2003, our matching

contribution was equal to 100% of the first 6% of a participant’s pay (4% for higher paid individuals), only if the

participant elected to invest in our company stock fund through salary deferral contributions. Subsequent to

August 1, 2003, our matching contribution is equal to 50% of the participant’s salary deferral contribution each

pay period, taking into account only those contributions that do not exceed 6% of the participant’s eligible pay

for the pay period (4% for higher paid individuals). Participants are no longer required to invest in our company

stock fund in order to receive matching contributions. For the first five years of the participant’s employment, all

matching contributions generally vest at the rate of 20% per year of service, measuring service from the

participant’s hire date. Thereafter, all matching contributions vest immediately. Our contributions to the plan

were $2,850,000 in fiscal 2004, $3,540,000 in fiscal 2003 and $4,433,000 in fiscal 2002.

We have a nonqualified executive deferred compensation plan that provides supplemental retirement income

benefits for a select group of management, and other certain highly compensated employees. This plan permits

eligible employees to make salary and bonus deferrals that are 100% vested. We have an unsecured obligation to

pay in the future the value of the deferred compensation adjusted to reflect the performance, whether positive or

negative, of selected investment measurement options, chosen by each participant, during the deferral period. At

January 30, 2005, $10,348,000 was included in other long-term obligations. Additionally, we have purchased life

insurance policies on certain participants. The cash surrender value of these policies was $8,271,000 at January

30, 2005 and was included in other assets.

Note K: Financial Guarantees

In November 2002, the FASB issued FIN 45, “Guarantor’s Accounting and Disclosure Requirements for

Guarantees, Including Indirect Guarantees of Indebtedness of Others,” which requires certain guarantees to be

recorded at fair value. In general, the interpretation applies to contracts or indemnification agreements that

contingently require the guarantor to make payments to the guaranteed party based on changes in an underlying

obligation that is related to an asset, liability, or an equity security of the guaranteed party. We leased an aircraft

over a term of 60 months, which ended in January 2005. At the end of the lease term, the lease allowed us to

either purchase the aircraft for $11,500,000 or sell it. If the proceeds were less than $11,500,000, we were

required to pay the lessor the difference up to $9,080,000. In January 2005, we purchased the aircraft for

$11,500,000 and the lessor released our guarantee requirements.

54