Pizza Hut 2002 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7.

our very best operators to develop simplified operating and training systems. Our operating measures and margins

now approach those of our single brand units, but we still have much work to do. However, given the sales and profit

upside, the pain of working through the executional issues is more than compensated for by the gain we are gen-

erating. The best proof of this is that over 40% of our multibrand units are being opened by franchisees putting their

own hard-earned money in the game. Since franchisees only get behind initiatives that make sense for their customers

and long term economics, you can tell from their investment they’re as excited about multibranding as we are.

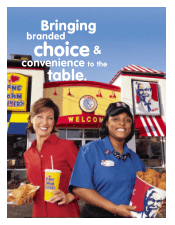

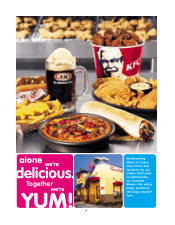

The bottom line is we now know multibranding is potentially the biggest sales and profit driver for the restaurant

industry since the advent of the drive-thru window. Asset sales leverage is the key to profitability in any retail category,

and multibranding provides that leverage for us. Our goal is to ultimately offer two brands in the vast majority of our

restaurant locations. We added almost 350 multibrand locations this year. With over 1,975 multibranded restaurants,

multibranding now represents nearly 6% of our worldwide system and about $2 billion in annual system sales.

Importantly, this strategy is very unique to Yum! We have a portfolio of leading brands. We have a huge asset

base of existing restaurants that is not capacity constrained. We have unpenetrated trade areas. We have a great

head start. And we’re really just getting started. Our goal is to transform the quick-service restaurant landscape

with multibranding.

#3 IMPROVING OPERATIONS OF OUR

GREAT BRAND PORTFOLIO WITH CUS-

TOMER MANIA. As you can see in this chart, we have the

leading brands in four major categories: pizza, chicken, Mexican-

style food, and seafood. A&W also gives us a quality hamburger

chain. Make no mistake. Growing these core brands is Job #1 for us!

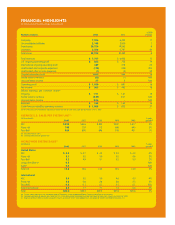

Over the past 15 years, we’ve averaged about 2% blended domes-

tic same store sales growth. Yet, we’ve had some inconsistency by

brand (especially quarter to quarter) because we know we’re not nearly as good as we should be at running great

restaurants and making our customers happy. The rude reality is that our customer survey results indicate we rank

only in the middle to bottom tier on the basics, and the attitude we convey to our customers is frankly not as con-

sistently positive as it needs to be. We know the more our customers can count on a trusted experience every time

they visit one of our restaurants, the more consistent our sales will be. In 2002, Yum! was up 2% on a blended or

combined same store sales basis in the U.S. Taco Bell led the way, with same store sales up 7%, and KFC and Pizza

Hut were only flat, so clearly we can and should do better.

“Customer Mania to me is the

determination to have each and

every customer that comes

through your door become a

repeat customer

—

for life.”

Jim Vavrek, LJS/A&W Area Coach

seafood & Mexican

quick-service categories.

pizza,

chicken,

in the

leader

LEADERS IN FOUR FOOD CATEGORIES

(QSR Sales)

•Mexican 65%

•Chicken 46%

•Seafood 33%

•Pizza 15%

SOURCE: NPD Group, Inc./CREST

We are the

65%

46%