Pizza Hut 2002 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

payroll and employee benefits and occupancy and other oper-

ating expenses.

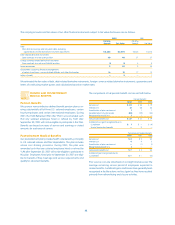

2002 2001 2000

Stores held for sale at December 28, 2002:

Sales $ 228 $ 228 $ 221

Restaurant profit 31 26 28

Stores disposed of in 2002, 2001 and 2000:

Sales $ 147 $ 436 $ 948

Restaurant profit 20 43 115

Restaurant margin includes a benefit from the suspension of

depreciation and amortization of approximately $6 million, $1 mil-

lion and $2 million in 2002, 2001 and 2000, respectively.

Unusual Items (Income) Expense

2002 2001 2000

U.S. $3 $15 $ 29

International (1)

—

8

Unallocated (29) (18) 167

Worldwide $ (27) $ (3) $ 204

Unusual items income in 2002 primarily included: (a) recoveries

of approximately $39 million related to the AmeriServe Food

Distribution Inc. (“AmeriServe”) bankruptcy reorganization process;

less (b) integration costs of approximately $6 million related to the

YGR acquisition; and (c) costs to defend certain wage and hour lit-

igation. See Note 25 for discussions of the AmeriServe bankruptcy

reorganization process.

Unusual items income in 2001 primarily included: (a) recov-

eries of approximately $21 million related to the AmeriServe

bankruptcy reorganization process; less (b) aggregate settlement

costs of $15 million associated with certain litigation; and (c)

expenses, primarily severance, related to decisions to streamline

certain support functions. The reserves established related to deci-

sions to streamline certain support functions were utilized in 2002.

Unusual items expense in 2000 included: (a) $170 million of

expenses related to the AmeriServe bankruptcy reorganization

process; (b) an increase in the estimated costs of settlement of cer-

tain wage and hour litigation along with the associated defense

costs incurred in 2000; (c) costs associated with the formation of

new unconsolidated affiliates; less (d) the reversal of excess

provisions arising from the resolution of a dispute associated with

the disposition of our non-core businesses, which is discussed in

Note 24.

SUPPLEMENTAL CASH FLOW DATA

2002 2001 2000

Cash Paid for:

Interest $ 153 $ 164 $ 194

Income taxes 200 264 252

Significant Non-Cash

Investing and Financing Activities:

Assumption of debt and capital leases

related to the acquisition of YGR $ 227 $

—

$

—

Capital lease obligations incurred

to acquire assets 23 18 4

Issuance of promissory note to acquire

an unconsolidated affiliate

——

25

Contribution of non-cash net assets

to an unconsolidated affiliate

—

21 67

Assumption of liabilities in connection

with a franchisee acquisition

—

36 6

Fair market value of assets received

in connection with a

non-cash acquisition

—

9

—

FRANCHISE AND LICENSE FEES

2002 2001 2000

Initial fees, including renewal fees $33 $32 $48

Initial franchise fees included

in refranchising gains (6) (7) (20)

27 25 28

Continuing fees 839 790 760

$866 $ 815 $ 788

OTHER (INCOME) EXPENSE

2002 2001 2000

Equity income from investments

in unconsolidated affiliates $ (29) $ (26) $ (25)

Foreign exchange net (gain) loss (1) 3

—

$ (30) $ (23) $ (25)

NOTE

10

NOTE

9

NOTE

8

56.