Pizza Hut 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

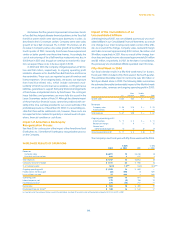

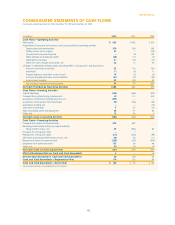

In 2001, net cash provided by operating activities was $832

million compared to $491 million in 2000. Excluding the impact

of the AmeriServe bankruptcy reorganization process, cash pro-

vided by operating activities was $704 million versus $734 million

in 2000.

Net cash used in investing activities was $885 million ver-

sus $503 million in 2001. The increase in cash used was primarily

due to the acquisition of YGR and higher capital spending in 2002,

partially offset by the acquisition of fewer restaurants from fran-

chisees in 2002.

In 2001, net cash used in investing activities was $503 million

versus $237 million in 2000. The increase in cash used was pri-

marily due to lower gross refranchising proceeds as a result of

selling fewer restaurants in 2001 and increased acquisitions of

restaurants from franchisees and capital spending. The increase

was partially offset by lapping the funding of a debtor-in-posses-

sion revolving credit facility to AmeriServe in 2000.

Although we report gross proceeds in our Consolidated

Statements of Cash Flows, we also consider refranchising proceeds

on an “after-tax” basis. We define after-tax proceeds as gross

refranchising proceeds less the settlement of working capital lia-

bilities (primarily accounts payable and property taxes) related to

the units refranchised and payment of taxes on the gains. The

after-tax proceeds can be used to pay down debt or repurchase

shares. After-tax proceeds were approximately $71 million in 2002

which reflects a 21% decrease from 2001. This decrease was due

to the refranchising of fewer restaurants in 2002 versus 2001.

Net cash used in financing activities was $187 million ver-

sus $352 million in 2001. The decrease is primarily due to lower

debt repayments and higher proceeds from stock option exercises

versus 2001, partially offset by higher shares repurchased in 2002.

In 2001, net cash used in financing activities was $352 million

compared to $207 million in 2000. The increase in cash used is

primarily due to higher repayment of debt, partially offset by fewer

shares repurchased in 2001 compared to 2000.

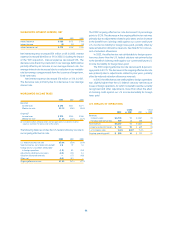

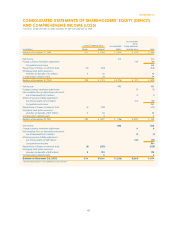

In November 2002, our Board of Directors authorized a new

share repurchase program. This program authorizes us to repur-

chase, through November 20, 2004, up to $300 million of our

outstanding Common Stock (excluding applicable transaction

fees). During 2002, we repurchased approximately 1.2 million

shares for approximately $28 million under this program.

In February 2001, our Board of Directors authorized a share

repurchase program. This program authorized us to repurchase

up to $300 million of our outstanding Common Stock (excluding

applicable transaction fees). This share repurchase program was

completed in 2002. During 2002, we repurchased approximately

7.0 million shares for approximately $200 million under this pro-

gram. During 2001, we repurchased approximately 4.8 million

shares for approximately $100 million.

40.

In September 1999, our Board of Directors authorized a share

repurchase program. This program authorized us to repurchase

up to $350 million of our outstanding Common Stock (excluding

applicable transaction fees). This share repurchase program was

completed in 2000. During 2000, we repurchased approximately

12.8 million shares for approximately $216 million.

See Note 21 for a discussion of the share repurchase programs.

FINANCING ACTIVITIES

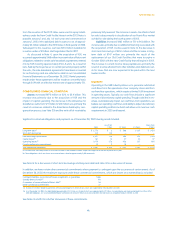

On June 25, 2002, we closed on a new $1.4 billion senior unse-

cured Revolving Credit Facility (the “New Credit Facility”). The New

Credit Facility replaced the existing bank credit agreement which

was comprised of a senior unsecured Term Loan Facility and a

$1.75 billion senior unsecured Revolving Credit Facility (collectively

referred to as the “Old Credit Facilities”) that were scheduled to

mature on October 2, 2002. On December 27, 2002, we volun-

tarily reduced our maximum borrowings under the New Credit

Facility from $1.4 billion to $1.2 billion. The New Credit Facility

matures on June 25, 2005. We used the initial borrowings under

the New Credit Facility to repay the indebtedness under the Old

Credit Facilities.

The New Credit Facility is unconditionally guaranteed by our

principal domestic subsidiaries and contains other terms and

provisions (including representations, warranties, covenants, con-

ditions and events of default) similar to those set forth in the Old

Credit Facilities. Specifically, the New Credit Facility contains finan-

cial covenants relating to maintenance of leverage and fixed

charge coverage ratios. The New Credit Facility also contains affir-

mative and negative covenants including, among other things,

limitations on certain additional indebtedness, guarantees of

indebtedness, cash dividends, aggregate non-U.S. investment and

certain other transactions as defined in the agreement.

Under the terms of the New Credit Facility, we may borrow up

to the maximum borrowing limit less outstanding letters of credit.

At December 28, 2002, our unused New Credit Facility totaled

$0.9 billion, net of outstanding letters of credit of $0.2 billion. The

interest rate for borrowings under the New Credit Facility ranges

from 1.00% to 2.00% over the London Interbank Offered Rate

(“LIBOR”) or 0.00% to 0.65% over an Alternate Base Rate, which is

the greater of the Prime Rate or the Federal Funds Effective Rate

plus 1%. The exact spread over LIBOR or the Alternate Base Rate,

as applicable, will depend upon our performance under specified

financial criteria. Interest is payable at least quarterly. In the third

quarter of 2002, we capitalized debt issuance costs of approxi-

mately $9 million related to the New Credit Facility. These debt

issuance costs will be amortized into interest expense over the life

of the New Credit Facility.

In June 2002, we issued $400 million of 7.70% Senior Unse-

cured Notes due July 1, 2012 (the “2012 Notes”). The net proceeds