Pizza Hut 2002 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2002 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63.

Yum! Brands Inc.

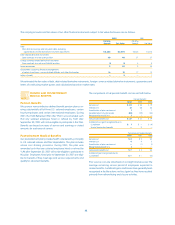

The change in benefit obligation and plan assets and reconciliation of funded status is as follows:

Postretirement

Pension Benefits Medical Benefits

2002 2001 2002 2001

Change in benefit obligation

Benefit obligation at beginning of year $ 420 $ 351 $58 $48

Service cost 22 20 22

Interest cost 31 28 44

Plan amendments 14 1

——

Special termination benefits

—

2

——

Curtailment (gain) (3) (3)

——

Benefits and expenses paid (16) (17) (3) (3)

Actuarial loss 33 38 77

Benefit obligation at end of year $ 501 $ 420 $68 $58

Change in plan assets

Fair value of plan assets at beginning of year $ 291 $ 313

Actual return on plan assets (24) (51)

Employer contributions 148

Benefits paid (16) (17)

Administrative expenses (1) (2)

Fair value of plan assets at end of year $ 251 $ 291

Reconciliation of funded status

Funded status $ (250) $ (129) $ (68) $ (58)

Employer contributions(a) 25

———

Unrecognized actuarial loss 169 87 18 12

Unrecognized prior service cost 16 4

——

Net amount recognized at year-end $ (40) $ (38) $ (50) $ (46)

(a) Reflects a contribution made between the September 30, 2002 measurement date and December 28, 2002.

Amounts recognized in the statement of financial position consist of:

Accrued benefit liability $ (172) $ (84) $ (50) $ (46)

Intangible asset 18 8

——

Accumulated other comprehensive loss 114 38

——

$ (40) $ (38) $ (50) $ (46)

Other comprehensive loss attributable to change

in additional minimum liability recognition $76 $38

Additional year-end information for pension plans

with benefit obligations in excess of plan assets

Benefit obligation $ 501 $ 420

Fair value of plan assets 251 291

Additional year-end information for pension plans

with accumulated benefit obligations in excess of plan assets

Benefit obligation $ 501 $ 420

Accumulated benefit obligation 448 369

Fair value of plan assets 251 291

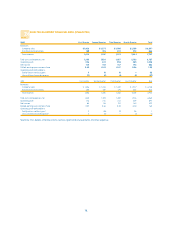

The assumptions used to compute the information above are set forth below:

Postretirement

Pension Benefits Medical Benefits

2002 2001 2000 2002 2001 2000

Discount rate 6.85% 7.60% 8.03% 6.85% 7.58% 8.27%

Long-term rate of return on plan assets 8.50% 10.00% 10.00%

———

Rate of compensation increase 3.85% 4.60% 5.03% 3.85% 4.60% 5.03%